Dialogue on Climate Change and Sustainable Development

Information

China Development Institute (CDI) and the New Zealand China Council (NZCC) recently held a joint virtual dialogue on climate change and sustainable development.

The dialogue included two sessions “Net-zero emissions strategies” and “Green transportation”. Experts from China and New Zealand shared climate change policies from their respective countries, practical experiences in electrifying public transportation, challenges and future outlooks for sustainable development.

The organisations that these experts represent include: the Chinese Academy of Environmental Planning, the New Zealand Ministry of Transport, the Chinese Academy of Social Sciences, the Auckland City Council, the Shanghai Academy of Social Sciences, the New Zealand Climate Change Commission, the China Academy of Urban Planning and Design, the University of Auckland, the Shenzhen Bus Group, the Auckland University of Technology (AUT), and the New Zealand Centre for Sustainable Finance.

Time/Date:

09:30-12:00 (China Time)

Wednesday, 23 February 2022

RCEP at new stage and its Role as engine of regional economy info

Information

2022 marks the beginning of the world’s largest free trade agreement, the Regional Comprehensive Economic Partnership (RCEP).

Against the backdrop of the ongoing global pandemic and a struggling global economy, the RCEP is expected to boost regional economic recovery and create economic momentum for years to come.

This edition of CDI webinar aims to provide a platform for open and inclusive dialogue between scholars from RCEP member countries,

with the shared information and insights helping attendees to better understand and benefit from the RCEP.

Focus

- Among the wide range of topics covered by the RCEP agreement, which specific areas are suitable for the early harvests of win-win cooperation under the RCEP?

- How should RCEP member countries collaboratively build a resilient and safe regional supply chain and value chain, which facilitates the regional economic stability?

- How can local businesses adapt and benefit from the RCEP, especially the MSMEs that have been hit the hardest by the changing global economic landscape?

This webinar is made possible with the invaluable support from fellow think tanks. As we strengthen bonds with old friends, we look forward to building new friendships in 2022.

In order of appearance:

- Chinese Academy of International Trade and Economic Cooperation

- Institute of Developing Economies Japan External Trade Organization

- The Australian National University

- University of Auckland, New Zealand

- Korea Institute for International Economic Policy

- KSI Strategic Institute for Asia Pacific, Malaysia

- Thailand Development Research Institute

- Singapore Institute of International Affairs

- University of the Philippines Diliman

- Royal Academy of Cambodia

- Universiti Brunei Darussalam

- Central Institute for Economic Management, Vietnam

- Center for Strategic and International Studies, Indonesia

Zoom meeting registration:

https://us06web.zoom.us/meeting/register/tZcrdO6sqT4qHtGJkg3Ve6OOFUwM-4ij7jXc

Yuan may appreciate further in 2022, but not hit 6 to the dollar

Growth continues to be weak. In November, industrial output grew 3.8% y/y, down 1.1 pps from Q3, much lower than the growth rates of recent years. Investment is also low, and was up 7.9% y/y, and down 1.2 pps from January-June. Its adjusted growth rate is instead negative. The real estate market is still cold: sales were down -14.2% y/y in November.

Consumption rose 3.9% y/y in November, down 1 pps from October, and its adjusted growth rate was 0.5% y/y, hitting its lowest level this year. But trade is still strong. Imports were up 26% y/y, and up 9.8 pps from Q3. Exports were up16.6% y/y.

Producer price growth finally reversed to a downward trend. The price level of the index of ex-factory industrial goods was the same as in October, and up 12.9% y/y, down 0.6 pps from October. PPI increased 1% m/m, 17.4% y/y from October, up 0.3 pps from October. We expect PPI growth to be slower next month. In November, CPI rose 2.3% y/y, up 0.8 pps from October. Its adjusted growth rate is the same as in October.

Principal financial indicators operated at low levels in November. M2 rose 8.5% y/y, comparable with 2018 and 2019. M1 rose 3%, up only 0.2 pps from the lowest growth rate this year. There is still uncertainty over whether money growth’s downward trend will be reversed. Loan growth has been at its lowest since 1990, for three consecutive months.

The yuan has risen 2.6% against the dollar this year, even with the dollar strengthening 8% since May. This is in contrast to an unexpectedly weaker Chinese economy, and to real estate risks highlighted in the news headlines. Appreciation is likely due to strong export and investor confidence. We expect that the yuan may appreciate mildly in 2022, and that it won’t fall below 6 against the dollar. This is based on an expected stronger dollar, and expectations of further growth slowdown in China in 2022.

Dialogue between China's Greater Bay Area and San Francisco Bay Area

Information

As one of the most consequential bilateral relationships in the world, the stability of China-US relations will have a far-reaching impact on the recovery of global economy. In the recent Xi-Biden virtual meeting, both sides have exchanged views on the issues of common concern.

In recent years, though the global economy remaining sluggish, China's GBA and San Francisco Bay Area are still considered the leading dynamic regions in terms of industrial development and innovation. Based on this, China Development Institute is about to host an online expert dialogue on December 10, 2021(Beijing Time)to explore the synergies of the two Bay Areas in innovative development, industrial investment and other fields from regional perspective.

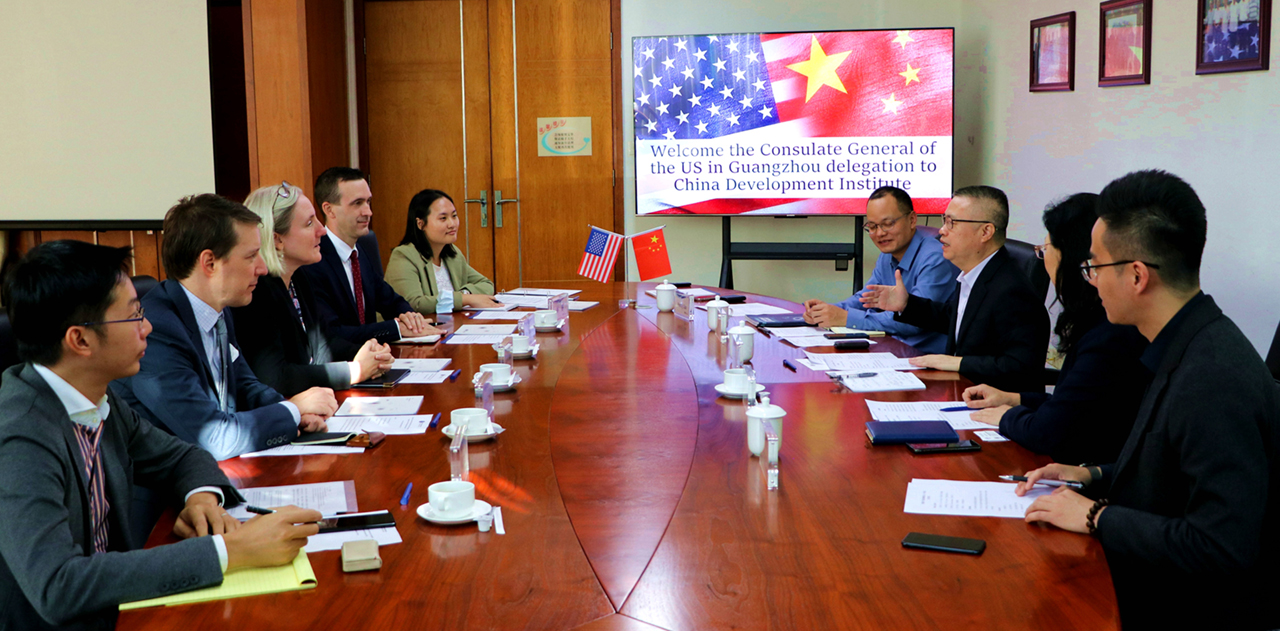

Ms. Lisa K. Heller Consul General of the U.S. in Guangzhou visited CDI

On November 29, Ms. Lisa K. Heller met with Dr. Guo Wanda, Executive Vice President of CDI in Shenzhen, China. During the meeting, Dr. Guo briefly summarized China’s overall economic performance in 2021 which was largely driven by the “dual circulation” development model. Given that the U.S. and China’s economic growth will both face a number of challenges, such as the ongoing global pandemic, global inflation, and supply chain restructuring, both sides agreed that the U.S. and China should maintain a stable and open dialogue and stay focused on the long-term benefits, especially in the area of green economy and carbon neutrality. As two major emitters, the U.S. and China should work collaboratively towards reaching each other’s respective carbon goals.

RCEP: Sino-Japan Economic and Trade Cooperation Outlook

Information

The Regional Comprehensive Economic Partnership (RCEP) trade agreement will take effect starting from Jan 1, 2022. What are the opportunities and challenges faced by China and Japan bilateral trade and economic exchange? What are the implications for Sino-Japan industrial cooperation?

On November 4th, 2021, China Development Institute and Pangoal Institution co-organized webinar on Sino-Japan industrial development and bilateral cooperation under RCEP.

China and Japan have large room for cooperation in emerging industries and the two sides should seek complementary development, scholars said on Thursday.

They made the remarks at an online seminar on China-Japan industrial cooperation and development, co-organized by the Shenzhen-based think tank China Development Institute and Beijing-based think tank Pangoal Institution.

"For China and Japan, the space for cooperation in traditional industries is not that large. But in emerging industries, it is huge," said He Jun, director of the enterprise innovation research office of the Institute of Industrial Economies at the Chinese Academy of Social Sciences.

"This is because each of the two countries has developed unique advantages in emerging industries. Therefore, they can leverage each other's strengths to jointly promote the development of those industries."

He took the industrial internet as an example. "While Japan excels in software and operational technology, China is developed in communication technology. If the two could work together to form a sound cooperative mechanism, it will be a win-win situation for both sides."

He's view was echoed by Cao Zhongxiong, director of the New Economy Research Centre at CDI, who believes China and Japan could explore more cooperation in blue ocean markets in the digital field by integrating China's digital technologies with Japan's manufacturing.

Japan can also provide talent support for the development of the Chinese digital economy, he added.

Cao also noted that China's globalization drive, transformation of industrial structure and consumption upgrade will create large opportunities for Japan and called on Japan to grasp the opportunities.

-China-Japan industrial cooperation still has big room to grow, China Daily, Nov 5, 2021

(source:https://enapp.chinadaily.com.cn/a/202111/05/AP6184e5e3a310b7d50bab6978.html)

China-Japan industrial cooperation still has big room to grow

China and Japan have large room for cooperation in emerging industries and the two sides should seek complementary development, scholars said on Thursday.

They made the remarks at an online seminar on China-Japan industrial cooperation and development, co-organized by the Shenzhen-based think tank China Development Institute and Beijing-based think tank Pangoal Institution.

"For China and Japan, the space for cooperation in traditional industries is not that large. But in emerging industries, it is huge," said He Jun, director of the enterprise innovation research office of the Institute of Industrial Economies at the Chinese Academy of Social Sciences.

"This is because each of the two countries has developed unique advantages in emerging industries. Therefore, they can leverage each other's strengths to jointly promote the development of those industries."

He took the industrial internet as an example. "While Japan excels in software and operational technology, China is developed in communication technology. If the two could work together to form a sound cooperative mechanism, it will be a win-win situation for both sides."

He's view was echoed by Cao Zhongxiong, director of the New Economy Research Centre at CDI, who believes China and Japan could explore more cooperation in blue ocean markets in the digital field by integrating China's digital technologies with Japan's manufacturing.

Japan can also provide talent support for the development of the Chinese digital economy, he added.

Cao also noted that China's globalization drive, transformation of industrial structure and consumption upgrade will create large opportunities for Japan and called on Japan to grasp the opportunities.

Growth weakens, though more structural reforms are underway

Growth has weakened, especially in services. In August, industrial output grew 5.3% y/y, and was up 11.2% from August 2019, with an annualized growth rate of 5.4%, down 0.2 ppts from July, and down 1.2 ppts from Q2. The service production index has slowed since Q2, and grew only 4.8% y/y in August, after being further hit by the COVID outbreaks, down 2.9 ppts from Q4 2020, and down 2.1 ppts from 2019.

Investment was up 8.9% y/y January-August, and increased 8% from August 2019, with an annualized growth rate of 4%, down 0.5 ppt from H1. Real estate is cooling dramatically, to the 2008 financial crisis level. COVID outbreaks in August negatively impacted consumption. Retail sales of social consumption goods rose 2.5% y/y, down 6 ppts from July. Their growth rate after price adjustment was 0.9% y/y. As we forecast, trade became weaker. Exports rose 15.7% y/y, down 4.4 ppts from Q2. Imports rose 23.1% y/y, down 8.5 ppts from Q2.

Producer prices increased further in August. The ex-factory price index of industrial goods rose 9.5% y/y; PPI increased 13.6% y/y, both 0.5 ppts higher from July. However, we forecast that producer price appreciation will stabilize in November, and that prices will begin to fall. CPI rose 0.8% y/y, falling for three consecutive months. We expect the lowering of CPI to be temporary, and to reach around 2%, after food prices stop declining.

In August, monetary policy continued its tightening trend. M2 rose 8.2% y/y, basically stable since April. M1 rose 4.2% y/y, continuing to fall, reaching its the lowest of 2021, down 0.7 ppts from July.

China is announcing intensive policies in specific key areas, to address structural reform. In the financial industry area, President Xi Jinping announced on September 2nd that a third stock exchange in Beijing would be established, in addition to the existing two exchanges in Shanghai and Shenzhen, to serve small and medium-sized businesses. In regional policies, Shenzhen’s Qianhai and Zhuhai’s Hengqin areas are being pushed to deepen their ties with bordering Hong Kong and Macau. The Qianhai economic zone is to expand eightfold. There are also other new industry rules for the real estate and education sectors. All of these plans underscore the central government’s effort to develop a healthier economy, by being more open and more market-based. But policy uncertainty looms over investment in the short term. The possible default of real estate companies such as Evergrande also raises some fear of turmoil in China’s financial market. But we do not see this as a systematic threat.

Carbon Neutrality and Green Economy

Information

With the consensus of limiting global warming, China, the world’s largest developing nation and greenhouse gas emitter, has announced the goal to reach CO2 emission peak before 2030 and carbon neutrality before 2060. It goes without saying that enormous challenges lie ahead. Meanwhile, many developed nations have already reached peak emission before the turn of the century and have since accumulated abundant and mature case experiences.

What and how can China learn from EU countries’ progression towards carbon neutrality so as to better align with the international standards? How can the two sides collaborate and complement each other in the process of energy transition and carbon emission reduction?

Bearing in mind the mutual vision for a common future and shared prosperity, China Development Institute will bring together public representatives, academics, and professionals in hope to provide insights on the next steps for approaching carbon neutrality and green economy.

Date: Sept 17, 2021

Venue: Jianguo Garden Hotel, Beijing, China

Host: CDI

Theme: Carbon Neutrality and Green Economy

Experiences of Shenzhen’s high-quality development

Author: Guo Wanda, Executive Vice President of CDI

Editor’s note: Shenzhen Guangming Science City, which initially covered just 10 square kilometres, now covers close to 100 sq km and has become a key centre for China’s comprehensive national science programme due to its important role in Shenzhen’s high-quality development. Dr. Guo Wanda, Executive Vice President of China Development Institute, provided some insights into Shenzhen’s high-quality development, using Guangming Science City as an example.

High-quality development implies the adoption of higher standards and tougher requirements than standard processes, which in turn warrant a transition from investment-driven to innovation-driven development. Guangming Science City exemplifies the new model of innovation-driven development, thanks to its integration of basic scientific research and applied scientific development. Such development has been advanced through the convergence of industry, innovation, investment, and policy, allowing the construction of modern industrial systems, the reform of older systems and mechanisms, and the construction of open and inclusive innovation methods.

High-quality development also requires new development phases, new development values, and new development patterns:

- Four decades after its “reform and opening-up”, China has transitioned from a traditional production factor intensive economy to a knowledge and science-based production factor intensive development phase.

- The main development value is now the idea of being people-centred, in a population that aspires to live better, higher quality lives.

- In addition, high-quality development is a prerequisite for smooth “internal and external dual circulation” – the new development pattern that was recently proposed by the central government.

The following four types of dynamics have been critical to Shenzhen’s dedication to high-quality development; they may thus also serve as lessons and inspirations for the rest of the country:

- The dynamics between the government and the market.

The market is the main driver of growth, which makes it important to let the market play its pivotal role of resource allocation effectively. The government can, however, achieve systemic innovation to better serve as a facilitator of technological innovation, with the former being the precursor of the latter.

- The dynamics between basic science research and industrial innovation.

Guangming Science City offers an example of basic science research, which requires government investment and guidance, propelling industrial development by means of research applications developed through interaction and collaboration among large-scale science facilities, universities, R&D institutions, and top-tier private companies.

- The dynamics between “opening-up” and independent research.

Key technologies cannot be given or bought, instead needing to be developed through independent research; however, this does not mean working behind closed doors, but instead adhering to the principals of opening-up by attracting world-leading scientists and researchers.

- The dynamics between talent and innovation.

Innovation and development both require human resources. A welcoming working environment equipped with proper resources and incentives will attract and retain the appropriate talent, as well as allowing the maximisation of their creativity and innovation to achieve the organic integration of talent, innovation, and industry.