Chen Lixin

Research Associate

Research Focus

Regional Economics, Industrial Planning, and Logistics

Education

Master of Economics, University of Sussex

Projects

Study on the development strategy of airport-type national logistics hub for Shenzhen, 2021

Study on the implementation strategy of China Merchants Group's Dalian Taiping Bay cooperation and innovation zone (2021-2035), 2021

Project proposal of Mengniu Group for building a modern national reserve center for dairy products, 2021

Tel:+86-755-8241 0997

e-mail:clx@cdi.org.cn

Zheng Yujie

Zheng Yujie is the Assistant President of China Development Institute. He is also expert of the Science and Technology Group of Shenzhen Pilot Demonstration Zone, member of the Standing Committee of the CPPCC Luohu District, Shenzhen, and President of the Luohu District Intellectual Association. He has been engaging in government decision-making research in the fields of urban economic development and strategic emerging industry planning throughout his career. He has presided over or participated in over a dozen of development planning research projects commissioned by national ministries and local governments, including "Research on Guangdong-Hong Kong-Macao Greater Bay Area: A World-class Science and Technology Innovation", "Policy Research on Shenzhen's Construction of an International Science and Technology Industry Innovation Center". His published books include "Dual Circulation: New Development Pattern for the 14th Five Year Plan Period".

Liu Guohong

Dr Liu Guohong is Vice President at China Development Institute. He is also the Director of the China Token Digital Economic Research Center. His research foci include finance, regional economics, industrial planning, innovation-driven growth, and business strategy. Dr Liu is the co-author of Public Welfare, Finance and Goodness Economy and is the editor in chief of China’s Financial Center Index 12 and China’s Entrepreneurship & Innovation Finance Index Report. His academic works have been published in various key academic journals. Dr Liu is also a registered consulting engineer. He received his Ph.D. in economics from Nankai University, China.

Zheng Tiancheng

Research Fellow,Department of Free Trade & Innovation, Department of Urban & Rural Development.

Research Focus

Macroeconomics、Guangdong-Hong Kong-Macao Greater Bay Area、Hong Kong and Macao, Urban Development、Urbanization、Industrial Planning

Education

Ph.D. at the Universidad Autónoma de Madrid, UAM, Madrid, Spain.

Master in Social Problems, the University of Granada, Spain.

Projects

Study on Function and Industrial Plan of Hefei Airport International Town,2018. Industrial Plan of Urban Renewal Project for Baishaling Area of Shenzhen,2018.

Industrial Plan of OCT-LOFT Urban Renewal Unit in Nanshan District Shenzhen,2019,

Industrial Plan of Urban Renewal Project for Songboyu Industrial Zone of Shenzhen,2019

Industrial Plan of Urban Renewal Project for Shenzhen Pacific Industrial Zone,2019

Industrial Plan of Urban Renewal Project for Baishaling Area of Shenzhen,2019

Industrial Development Plan of Xingtan Town Shunde District Foshan,2019

Master Plan of Xingyunhu New Town Foshan ,

Strategy of Coordinated Development of Urban and Rural Areas in Luoyang's High-Tech Industrial Development Zone,2019

Study on Rural Revitalization and Development of Tuqiaogou Village in Luoyang's High-Tech Industrial Development Zone,2019

Research on the leading role of Guangdong-Hong Kong-Macao Greater Bay Area in promoting institutional opening strategy under RCEP and other rules,2021

Action plan of Jiangmen in alignment with the construction of cooperation zones in Hengqin and Qianhai,2021

Study on deepening Qianhai-Shenzhen-Hong Kong cooperation strategy,2021

Policy innovation and implementation roadmap of cross-border flow of sci-tech innovation resources between Shenzhen and Hong Kong in Qianhai,2021

Study on the alignment of rules and mechanisms between Guangdong, Hong Kong and Macao: a case study of cooperation platforms in Hengqin, and Lok Ma Chau Loop,2021

Strengthening the legal integration of Zhuhai and Macao and accelerating the construction of Guangdong-Macao in-depth cooperation zone in Hengqin,2021

Easing market access and building Hengqin into a flagship of service industry in Guangdong-Hong Kong-Macao Greater Bay Area,2021

China’s Opening Up Beige Book (2019-2020)

Study on 40th Anniversary of Shenzhen Special Economic Zone,2021

Hong Kong's economic situation and the development of China Merchants Group's real estate and shipping industries in Hong Kong,

Changes in the situation in Hong Kong and the development of CGNPC's business in Hong Kong,2021

Suggestions on central enterprises supporting Hong Kong's economic and social development,2021

Study on the alignment of the development of Hong Kong and Macao with national development strategies during the 14th five-year plan period,2021

Development Plan of China-ROK (Changchun) International Cooperation Demonstration Zone during the 14th Five-Year Plan Period,2021

Study on Zhuhai’s talent scheme in the 14th five-year plan period,2021

Study on Zhuhai's economic development in the 14th five-year plan period,2021.

Publications

“Interview with Prof. Jesús M. De Miguel (in France) about Society, Globalization, and Urbanization in the Post-Covid Era.”(2021), Beijing Planning Review,pp. 206-211.

“The Focal Point of Shenzhen’s Construction of a Global City”, (2020),China Opening Journal, pp. 97-104.

Zheng,T.(2017)“CIUDADES GLOBALES: PROCESOS SOCIALES DE CAMBIO EN LAS NUEVAS CIUDADES CHINAS.” Madrid, Spain Universidad Autónoma de Madrid.

Gil, Olga and Tian-Cheng, Zheng, (2016), “The smart city plan 2011–2013 in Shanghai”, pp. 127-151, in Yi-Jia Jing and Stephen Osborne (eds.) Public Service Innovations in China. Singapur: Palgrave. https://link.springer.com/chapter/10.1007/978-981-10-1762-9_7.

Gil, Olga and Tian-Cheng, Zheng, (2015), “Smart cities through the lenses of public policy: the case of Shanghai”, Madrid, Spain

Revista Española de Política.

https://www.academia.edu/17727760/Smart_cities_through_the_lenses_of_public_policy_the_case_of_Shanghai_2015

Tel:+86-755-8247 7435

e-mail:ztc@cdi.org.cn

Financial Centre Futures Webclave: Future of Financial Centres & Public/Private Partnership

Information

Date and time: 15:30-17:30, July 28, 2022(GMT+8)

China Development Institute and Z/Yen Group are holding a special webclave to bring together representatives of financial centres across the world to discuss areas of common interest and in particular the Future of Financial Centres and Public Private Partnership.

The meeting is an opportunity for financial centres to share information on:

- The Future of Financial Centres – what are the key strategic themes in financial centres for the next period?

- Public/private partnership in financial centres – how to promote joint public/private investment, and strategic discussion between the public and private sectors?

Since 2020, CDI and Z/Yen started the annual financial centres online conclave as an alternative for international exchange for financial professionals cross the world. Past events focused on financial stimulative measures (2020) and financial centre’s contribution to meeting sustainable development goals (2021).

How Cooperation Platforms Planned to Further Reform, Opening-up in GBA?

Date: June 23, 2022

Author: Guo Wanda, Executive Vice President, China Development Institute

“The development of the Guangdong-Hong Kong-Macao Greater Bay (GBA) saw progress in three major aspects,” said Guo Wanda, Executive Vice President of China Development Institute (CDI). In addition to the improvement in transportation network & institutional connectivity and the industrial clusters & innovation ability, Guo highlighted the various platforms built to boost Guangdong-Hong Kong-Macao cooperation.

“We established major cooperation platforms like Hengqin, Qianhai, Nansha and Hetao as well as special platforms in cities such as Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing. These platforms have been particularly significant since the plans for Hengqin and Qianhai released last years and have the two regions to drive regional integration and development,” said Guo.

The GBA is a focal point in the report of the 12th CPC Guangdong Provincial Committee through which the Party summarized the province's performance over the past 5 years while unveiling future development blueprint. Having read the report, Guo shed insight into the government’s latest plans for the GBA, one of China’s most economically active regions, in a recent interview with GDToday.

Hengqin, Qianhai cooperation platforms proven effective

The report sets it a major goal to further reform and opening-up through the ‘synergistic effect’ generated by the development of GBA, Shenzhen as a pilot demonstration area of socialism with Chinese characteristics as well as Hengqin and Qianhai cooperation zones.

Guo elaborated the ‘synergistic effect’ means the effects on opening up to Hong Kong, Macao, to the world, and to global talents. “For example, the Hengqin and Qianhai cooperation zones have been piloting institutional reforms which allow Hong Kong and Macao professionals to provide services in the mainland much more easily. These platforms have proven effective as they facilitated regional integration and attract more foreign direct investment.”

According to a press conference on April 19, Hengqin has seen more than 4.7 thousand Macao-invested companies which have tripled over the past 2 years while 2021 has seen a 156 percent year-on-year increase of Hong Kong-invested enterprises settling down in Qianhai. As for Shenzhen, its actual use of FDI hit 11 billion USD in 2021 with a 10.2 percent of average annual growth in 2019 to 2021.

Guo highlighted Hengqin, Qianhai platforms are not only leading the integration of GBA but overflowing their effect into surrounding areas.

“Shenzhen Development and Reform Commission launched a research on joint development between Qianhai as well as Cuiheng and Binhaiwan, two cooperation platforms respectively in neighboring Zhongshan and Dongguan. The research examines the possibility of integrated development of the east bank and west bank of the Pearl River, which shows the overflow effect of the Qianhai,” said Guo.

High-tech industry, international cooperation highlighted in Nansha plan

Guo pays close attention to the overall plan for Nansha District in Guangdong's provincial capital Guangzhou to deepen comprehensive cooperation between Guangdong, Hong Kong and Macao, saying, “Nansha is positioned high as a‘major strategic platform’ for GBA integration and global cooperation.”

The Plan released by China’s State Council sets out 5 key directions for Nansha including high-level opening-up, rule-based connection mechanism, cooperation for sci-tech innovation, co-operation in youth innovation and entrepreneurship, and high-quality urban development. From 2022 to 2024, 10 billion RMB of new local government debt will be allocated to Nansha every year.

“The plan for Nansha might involve similar advantageous measures as the Plans for Hengqin and Qianhai, which makes sense considering the effective practice in the two cooperation zones. However, I would highlight Nansha has its unique industrial clusters that focus heavily on high technology,” said Guo,

According to the Nansha government, 744 high-tech enterprises and more than 620 AI and bio-tech companies have settled in the district. The auto industry is the pillar industry to drive development with an annual output of more than 154.8 billion RMB in 2021. Nansha is also one of the two districts that have given a green light to launch automatic driving on the pilot roads and areas.

“Nansha not only could be the manufacturing base for high-tech industries, but also provides an relatively open environment to apply these technologies such as unmanned vehicles, aircraft and underwater vehicles. It could facilitate the development of upstream industries such as new material and marine energy as well.”

Moreover, Guo considers Nansha’s development is highly related to the ability of technological innovation. The Hong Kong University of Science and Technology set up its Guangzhou campus in Nansha and will open in September this year while the Chinese Academy of Sciences (CAS) has landed a number of research institutes in the districts.

“When I visited Nansha, I was deeply impressed by the cold-seep seafloor ecosystem research device being built by the South China Sea Institute of Oceanology, CAS. Cold seeps are located at the sea floor where hydrocarbon-rich fluid seepage occurs. A deeper research into the cold seeps will reveal the secrets of the evolution of life on Earth, and contribute to research on energy and bio-technology,” he said excitingly.

Now that the plan positions Nansha as a strategic platform for global cooperation, Guo was invited by Nansha to research on more detailed strategies to develop the district into an international platform.

In his opinion, regulations up to international standards are fundamental to attract global players. “For example, our medical system is different from other countries. We need to press international standards on medical institutes, drug, and medical equipment manufacturers. Or if we plan to involve Hong Kong, Macao counterparts in urban development, more reform is required to recognize their different certificates and standards in the professional services sector.”

Platforms in other GBA cities have their own strengths

The report of the 12th CPC Guangdong Provincial Committee emphasizes the development of cooperation platforms in other GBA cities including Foshan, Huizhou, Dongguan, Zhongshan, Jiangmen and Zhaoqing.

Guo summarizes 4 major characteristics of the cooperation platforms in these cities. On the one hand, they emphasize the development of advanced manufacturing industries and strategic emerging industries which require a certain amount of R&D ability. On the other, they stress ecological conservation, smart city development, and the cooperation with Hong Kong and Macao.

“The Sanlongwan and Binhaiwan are respectively located in Foshan and Dongguan, the two cities with GDP exceeding 1 trillion RMB. Foshan is known for its well-developed manufacturing base while Dongguan is also a manufacturing city with rapid development in AI, bio-technology and information technology. The Cuiheng platform in Zhongshan will face enormous opportunities as the Shenzhen-Zhongshan link is schedule to open in 2024. We saw several major projects in the fields of manufacturing and energy settled in the platform in recent years,” said Guo.

He added the advantageous policies might slightly differ from platforms to platforms in terms of tax preference, rent, subsidies, and accommodation support policies. He suggested that people could make the decision considering the different geographic locations, strengths, costs, and cultures of these cities if looking to start their business or career in the GBA.

(Source: GDToday)

China and Germany Perspective: How to Respond to the Global Energy Crisis in a Changing World?

Information

Date and time: 15:00-17:00, July 12, 2022(GMT+8)

With the rising international geopolitical tensions and the shadow of the pandemic, the fluctuation in energy market has swept consequences across the globe. Facing the dramatic changes of global energy, China and Germany, the two major energy consumers in the world are seeking ways to maintain energy security and sustainability via energy transformation in the midst of such changes. During the past years, transition to renewable energy has been the shared goal for both countries. And that status quo as well as the prospects of the world energy market will help prompt the green cooperation between China and Germany.

In view of above situation, China Development Institute will hold a Webinar and convene experts from China and Germany debate on How to Respond to the Global Energy Crisis in a Changing World?

- How shall China and Germany respond to the reshaped energy landscape?

- In what way should China and Germany seek common ground and work together to tackle the global energy security issue?

- How should China and Germany advance bilateral exchanges in low-carbon industry, green technologies, and green supply chain?

Join the webinar:

https://us06web.zoom.us/webinar/register/WN_DvlRBUReRDqVbmnxK-FSWA

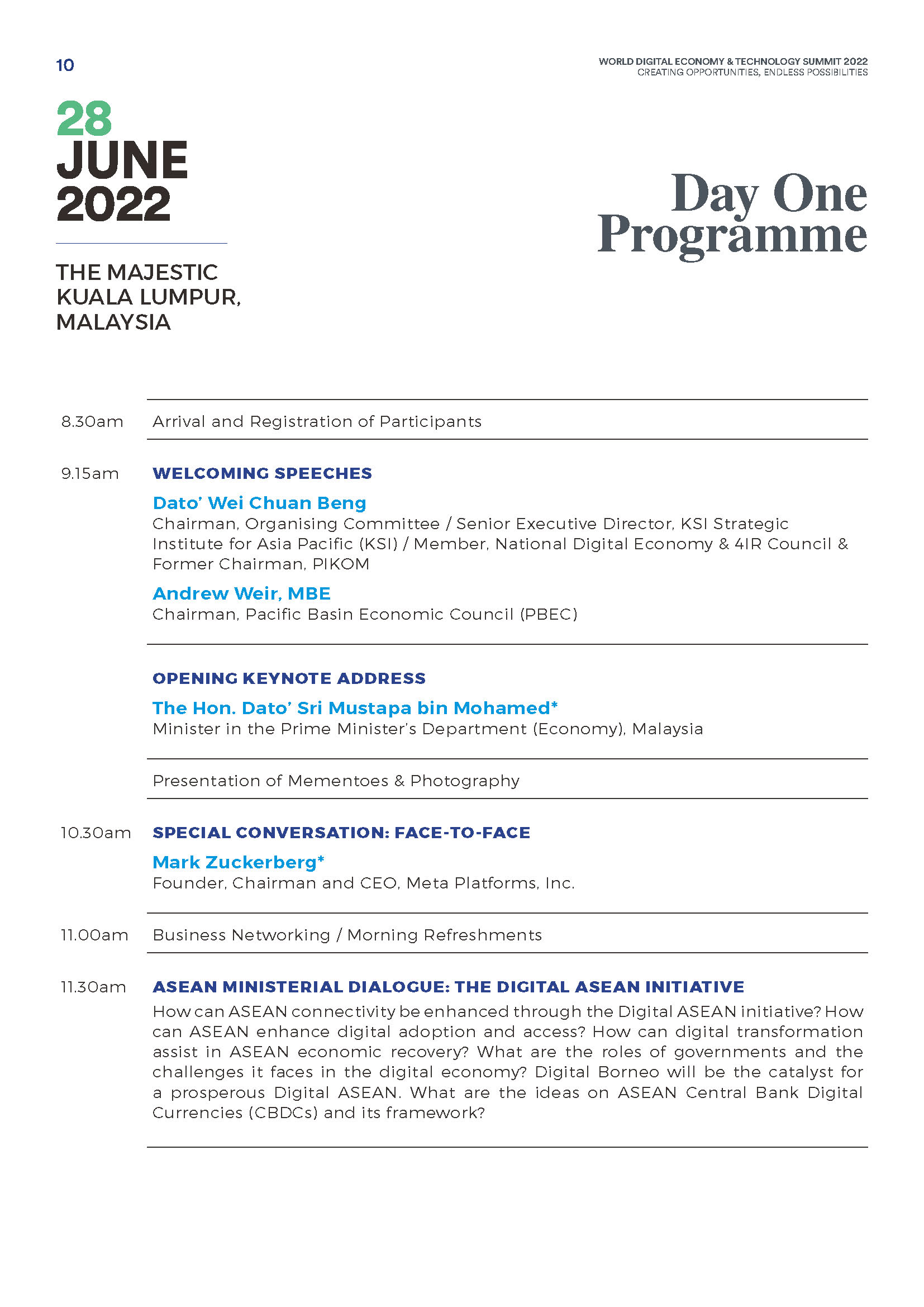

World Digital Economy & Technology Summit “Creating Opportunities, Endless Possibilities”

Information

Date: 2:00-3:15pm, June 29, 2022(GMT+8)

The World Digital Economy & Technology Summit is a high-level forum bringing together key stakeholders in the Digital Economy to discuss key trends, strategic challenges, major issues and risks impacting on our digital future. It is a meeting of minds from technologists, digital entrepreneurs, corporate executives, policy advocates, digital natives, health specialists, educationists, and civil society to take stock of the future digital economy and to be future ready. Dr. Guo Wanda. the executive vice president of CDI, will participate in this year’s edition and speak in Session 5: Smart Nation, Smart Cities and Smart Industries: The Future of Sustainability.

Why China’s Post-Covid Financial Relief Policies Matter?

Author: Liu Guohong, Assistant President, Director of Department of Financial Development and State-owned Assets and State-owned Enterprise Research.

As the Omicron outbreaks slowed down production across the globe, funding options have become limited but also urgently needed for private companies. Over the last two years, financial relief policies had been delivered rapidly to those pandemic-hit cities in China. In this regard, the accumulated experiences in policy implementation could serve as the role to stabilise and stimulate the market to greater effect.

What are the Problems facing China's post-Covid financial relief policies?

Policies that are packed with low-interest rate loans in order to reach more beneficiaries will lead to increased financial risk as the return on such loans cannot cover the cost of capital. Resultantly, financial institutions will become reluctant to supply the market with more capital, thereby compromising the efficiency of the financial relief policies.

The suppressed funding needs of certain companies rise to the forefront due to the surge of overeager bankers and the sudden drop in cost of funds. Thus, these companies sign on to financing programmes without a clear business plan. The compulsive investment into rapid expansion only leads to short-lived prosperity while losses and financial risks will increase with time goes on.

At the same time, customised policies for a green economy alongside science and technology innovation, finance are not widely known among MSMEs, which as such will not be able to take advantage of the prescribed financial concessions or privileges.

How to make the financial relief policies more effective?

Financial institutions, serving as middlemen between the capital supplier and receiver, bear the responsibility of not only providing necessary funds for the receivers on the demand side but also ensuring the safety and return of the capital. If fulfilled, people will then entrust financial institutions with their savings, allowing capital to be utilised and circulated. In other words, the sustainability and value addition capability of financial products are crucial for attracting more capital to empower the real economy. Therefore, financial institutions need to vet companies and supervise the relevant funds to suitably perform their role in capital allocation and risk management.

In the current context, financial relief policies should enable financial institutions to freely price their services within the policy’s selected range. In addition, more freedom in decision-making should be given, ensuring that limited financial resources and services are allocated to the companies with higher potential.

Moreover, the customized policies for a green economy alongside science and technology innovation finance need to be further promoted. The private sector, especially the MSMEs, need to prepare and make full use of these policies which allow financial institutions to have a higher tolerance for risk in the targeted sectors. This will be supportive to the fulfilment of stable and sustainable development.

Lastly, competition and cooperation among financial institutions should be encouraged. This can be promoted by additional service licenses being provisioned to the market by financial policies. With more financial institutions entering the market, the quality and efficacy of financial services will be able to improve further whilst costs diminish. In the meantime, the diversified financial service providers and the increased competition and cooperation within the industry will facilitate sustainable economic development and promote high-quality development.

The Global Economic Outlook: Investment, Trade and Cooperation

Information

Date and time: 15:00-15:45, Jun 16, 2022 (GMT+8)

This webinar will feature a discussion between Professor Fan Gang, President of China Development Institute and Professor Michael Mainelli, Executive Chairman, Z/Yen Group, UK.

With the aftermath of Covid-19, disruption to supply chains, inflationary pressures, and conflict placing the world's economic system under pressure, it is a good time to share thinking about the current challenges and potential futures, including:

- Trends in investment in trade as the world continues to cope with the impact of Covid-19

- Future resilience in supply chains and credit systems

- The prospects for achieving more stability in energy and food prices given the continuing effects of the pandemic and the Russian-Ukraine conflict

- The impact of Central Bank Digital Currencies on domestic economies and on trade

- The significance of carbon trading in the transition to a sustainable economy

- The potential for co-operation to help the world economy progress

Join the webinar:

https://register.gotowebinar.com/register/6882152664263487758