CDI Held Forums on Sino-US Economic Relations with US Think-tanks

Date: December 4, 2023

China Development Institute jointly held China US Bay Area Cooperation Conference with Bay Area Council Economic Institute and Standford Center on China's Economy and Institutions in San Francisco. Experts at the meeting held that despite the differences between China and the US, both countries are facing a series of common challenges, such as public health, climate change, and the stability of industrial chain and supply chain. China and the US should try to promote exchanges and cooperation between the two sides at the sub-national level, especially to strengthen non-governmental exchanges between China's Guangdong-Hong Kong-Macao Greater Bay Area and San Francisco Bay Area. More than 100 experts from the political, business and academic circles of China and the US attended the meeting.

China Development Institute also held the China-US Green Cooperation Forum with Rocky Mountain Institute in Aspen. Experts at the meeting stressed that although China and the US have been competing in terms of economic development and national security in recent years, addressing the global climate change has gradually become the common interest of the two countries, and also the whole world. Both countries should strive to reach consensus and join hands to achieve more economic progress while undertaking climate change mitigation and green transformation.

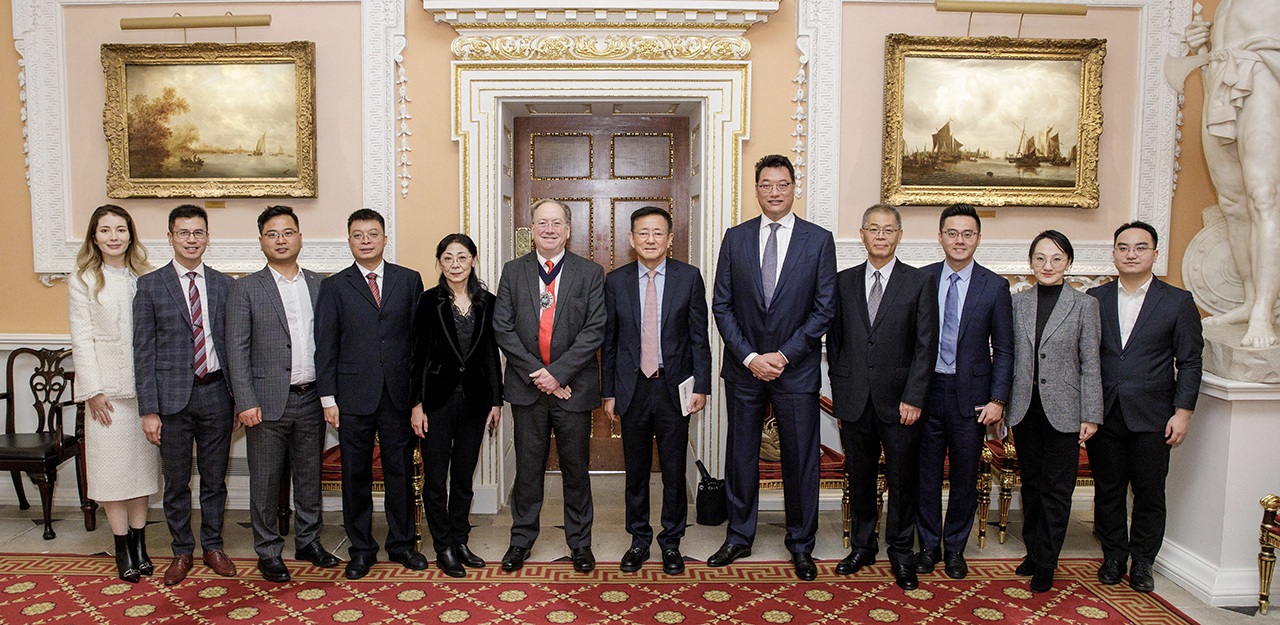

CDI Holds Forum on Sino British Relations and China’s Economic Outlook in Mansion House, London

Date: November 13, 2023

CDI joined hands with the City of London Corporation and the China Chamber of Commerce in the UKin hosting the forum on Sino-British relations and China’s economic outlook on November 13th in the UK. The forum centered on fostering trust and consensus between China and the UK, delving deep into discussions regarding China's economic growth prospects, opportunities and potential risks for Sino-British relations and financial collaboration.

The forum drew over 200 delegates from government, business, and academic circles. Key speakers included Prof. Fan Gang, President of CDI, and the Lord Mayor of the City of London, Prof. Michael Mainelli. Prof. Fan Gang centered his address on the prospects for China's economic development, emphasizing the progress of China's post-pandemic economy and society while advocating for further openness and collaboration. Lord Mayor Prof. Mainelli also underscored the significance of fostering a stable relationship between China and the UK. He further encouraged active trade and investment interactions, aiming to pave the way for a new chapter in Sino-British relations.

During CDI’s visit to the UK, the delegation conducted a series of academic seminars and visited several prominent British institutions, including the City of London Corporation, the Bank of England, Z/Yen Group, Scottish Development International, and the Scottish Financial Enterprise.

Economic Performances Fell Back, Policy Support Still Needed

Date: November 20, 2023

In October, China's economy may not appear to gain a strong recovery. However, a rational look at the situation shows there is some potential amid the current difficulties. Weakness in overseas manufacturing led to a decline in exports, impacting relevant industrial chains. Infrastructure and real estate investments remained weak, while manufacturing investment stayed stable owing to policy support and shifting demands. Supported by holiday promotions and a resurgence in service consumption, overall consumption remained resilient, although certain consumer goods experienced a slowdown in growth. Continuous decline in indicators including the Consumer Price Index (CPI) revealed the need for further stimulus including policy support to bolster internal momentum for economic growth.

October witnessed a slight decline in the Purchasing Managers’ Index (PMI), indicating a slowdown in the pace of overall economic expansion. The Composite PMI Output Index, Manufacturing PMI, and Non-Manufacturing Business Activity Index stood at 50.7%, 49.5%, and 50.6% respectively, dropping by 1.3, 0.7, and 1.1 percentage points compared to the previous month. All five sub-indices within the Manufacturing PMI registered decreases, signaling a deceleration in manufacturing production expansion, intensified demand contraction, reduced main raw material inventories, reduced labor use, and quicker delivery times from raw material suppliers. Furthermore, the Index of Service Production and Industrial Added Value demonstrated a slight acceleration compared to the previous month, primarily due to the base effect. While there was an increase in the year-on-year growth rate for October, the overall trend reveals a decline in the two-year compound annual growth rate for 2021-2023.

In October, exports were mainly influenced by seasonal factors and the global downturn in manufacturing industry prosperity. Regarding seasonality, there was an 8.1% month-on-month decrease in October’s exports, signaling ongoing instability in global demand. The global Manufacturing PMI dropped to 48.8%, reaching its lowest since July 2023. The growth in China’s exports to several regions also declined. In terms of products, the end of Christmas shipments led to a decline in the export growth rate of labor-intensive products. Simultaneously, the European Union’s anti-subsidy investigation into China’s new energy vehicles hindered the export growth of the automotive industry chain. Moreover, the export growth in the electronic industry chain displayed a divergence, with an uptick in mobile phone exports but a more significant decline in the exports of automated data processing equipment and integrated circuits.

For industrial enterprises above designated size, the year-on-year growth rate in October reached 4.6%, slightly up from the previous month, while the industrial growth rate from January to October slightly increased to 4.1%. Mining and manufacturing emerged as the primary drivers of growth, especially noticeable in the continuous three-month upturn in equipment manufacturing. However, after excluding the base effect, regarding the two-year compound annual growth rate, October saw a year-on-year growth rate of 4.8% for industrial enterprises above designated size, slightly down from the previous month. This decline was mainly due to specific industries stocking up ahead of time, resulting in the release of a portion of production demand last month. Inadequate foreign demand affected export-related manufacturing, while diminishing domestic demand in infrastructure and real estate investment continued to weaken related industrial chains.

October registered an overall year-on-year investment growth rate of 2.9%, showing a slight decrease compared to the previous month. Manufacturing investment remained stable, but there was a continued decline in both infrastructure and real estate investments. The slowdown in infrastructure investment growth can be attributed to factors such as a high base effect and a slowdown in the issuance of special bonds. Except for electricity, heating, and hydraulic power, the year-on-year growth rate in other sub-items has declined. Manufacturing investment experienced a slight dip, along with reduced investment in high-tech industries, automobile manufacturing, electrical machinery and equipment manufacturing, computer communications, and other electronic equipment manufacturing. Real estate investments, sales volume, sales area, and funding sources continued to weaken. Private real estate investment showed a marginal rebound overall, particularly noticeable when excluding real estate development investment, signaling a gradual recovery in the confidence for investment among private enterprises.

From January to October, there was a 6.9% year-on-year increase in retail sales of consumer goods. Notably, automobile consumption helped to boost overall consumer spending in October. From January to October, service retail sales saw a slight improvement with a 19.0% year-on-year growth. The effect of new energy vehicle policies started to be felt and resulted in an 11.4% growth in retail sales of passenger cars. The adjustment of policies in the real estate market also led sectors like home appliances, furniture, and building decoration to turn positive after 12 months. Regarding service consumption, the year-on-year growth rate of catering services rose to 17.1%. However, it is worth noting that the rebound in the growth rate of total retail sales of consumer goods was significantly influenced by a low base effect.

2023 Shenzhen Hong Kong Cooperation Forum

Information

Information

Within the Guangdong-Hong Kong-Macao Greater Bay Area (GBA), collaboration between Hong Kong and Shenzhen is the most iconic and advanced. How should the two major players take advantage of the developmental momentum of the GBA, while collaboratively exploring and identifying new growth poles?

On December 13, 2023, the China Development Institute and the One Country Two Systems Research Institute convened the Shenzhen Hong Kong Cooperation Forum, bringing together experts, professionals and representatives from the government to shed lights on the fresh challenges and prospects in the collaboration between Hong Kong and Shenzhen. Discussion revolved around solutions to effectively address pragmatic issues emerged in the collaboration between the two cities and to foster cooperation in crucial domains. A range of topics were covered, encompassing the Northern Metropolis's development, industrial cooperation, technological innovation, talent acquisition, and regional planning. Emphasis was placed on the pivotal role of technological innovation and industrial development in the regional economy.

Date: December 13, 2023

Hosts: China Development Institute, One Country Two Systems Research Institute

Venue: The Hong Kong Polytechnic University

Enhancing the Business Environment in the Greater Bay Area through Incorporating World’s Leading Methodologies and Practices

Date: Dec 28, 2023

Author: Dr. Yu Zongliang, Director, Research Center for Free Trade and Innovation, CDI

The Guangdong–Hong Kong–Macao Greater Bay Area (GBA) is among China’s most open, economically agile, and business-friendly regions. As of 2022, the GBA's GDP was approximately CNY 13.04 trillion, with a per capita GDP of approximately CNY 150,900. Despite occupying less than 1% of China's land area and being the home of only 5% of its population, the region contributes 11% of the nation's total economic output. In December 2023, the National Development and Reform Commission (NDRC) of China unveiled an action plan to further enhance the GBA's business environment.

Various domestic and international business environment rankings indicate that a better business environment correlates with greater economic prosperity. Therefore, a conducive business environment is crucial for promoting prosperity at the national, regional, and city levels, and serves as a key aspect of economic competitiveness. Enhancing the business environment in the GBA will support the creation of a first-class bay area and world-class city cluster that is dynamic and internationally competitive.

At the micro-level, the action plan revolves around effectively serving and enhancing the sense of growth and satisfaction among businesses by considering their complete lifecycles. This includes encompassing every stage of their development, reducing institutional costs, and ultimately benefitting the public.

From a reform perspective, the action plan highlights the transformation of government functions. The reform and innovation of internal systems and mechanisms fall under the umbrella of constructing a supportive environment within the superstructure.

By integrating advanced concepts and experiences globally, the GBA aims to establish a business environment system that aligns with international standards and achieves a world-class level of marketization, rule of law, and internationalization. Market connectivity levels will significantly improve, enabling the region to attract and allocate more global resources.

To achieve these goals, it is crucial to properly manage the following six relationships.

First is the relationship between the government, the market, and society. The construction of a favorable business environment entails collaborative efforts among diverse entities, such as the government, the market, and society, rather than unilateral actions by the government. Subsequently, the action plan includes aspects concerning social organizations, diversified dispute resolution mechanisms, and credit-building.

Second is the relationship between innovation and replication. Specifically, the various reform measures targeting the business environment are aimed at producing institutional innovations that can be replicated, rather than providing long-term exclusive policies for the few cities.

Third is the relationship between micro-reform and systematically integrated innovation. The action plan emphasizes locating and addressing the most pressing concerns of local people, even if small, then enabling an incremental and rapid progression of systematic initiatives to develop a better business environment.

Fourth is the relationship between local innovation and central facilitation. Coordination of top-level design with grassroots exploration is essential to fostering regional initiatives. The local grassroots level is closer to the market and is better informed and more up-to-date regarding the specific needs of local business entities. Therefore, the local level should be granted greater autonomy to boost reform and innovation.

Fifth is the relationship between policy and legal support. A clear and credible legal environment, in which the security of property and transactions is guaranteed, will enhance investors’ confidence and willingness to invest in and promote the market. Thus, it is necessary to promptly and effectively promote the establishment, modification, and interpretation of relevant laws, regulations, and rules to ensure the legality of reforms. This will also enhance the predictability and certainty of business environment reforms.

Last is the relationship between Hong Kong, Macao, and the nine mainland cities within the GBA. The GBA is unique, with its "one country, two systems", three customs territories, three legal systems, and three currencies, and requires Hong Kong, Macao, the mainland cities, and the central government to collaboratively promote market integration within it. This consists of compliance with international economic and trade rules and breaking the reliance on past practices of opening borders between Hong Kong, Macao and the Mainland.

How China Should Navigate Through the Economic Challenges

Date: Nov 23, 2023

During a recent interview, Prof. FAN Gang, President of China Development Institute, provided perspectives on the development of large enterprises, insights on the importance of fostering private enterprises and how China should navigate through the economic challenges that it faces now.

Synergies and Challenges in Diverse Business Scales

Businesses of all scales have the opportunity to innovate in a variety of ways. While small businesses may specialize in specific technological fields, they often struggle to achieve systematic technological development. On the other hand, large enterprises tend to integrate multiple technologies to create more comprehensive products. The large enterprises play a distinct and pivotal role in economic modernization especially within the innovation ecosystem, as they are able to catalyze a network of SMEs and integrate them into the innovation chain.

Furthermore, thanks to their ample capital and profits, large enterprises are able to make long-term, sustained investments into R&D, thereby propelling systematic and continuous innovation in fields like cloud technology and AI. Nevertheless, the key lies in establishing oligopolistic competition within the industry structure while averting monopolization, and ensuring ample space for innovation for SMEs.

Nurturing Private Enterprises for Economic Progress

When comparing China's private enterprises with state-owned enterprises (SOEs), significant differences exist. It is crucial to focus on the development of private enterprises as they are critical to China’s economic growth.

State-owned enterprises, due to their close ties with the government and other entities alike, exhibit weaker independence. Moreover, they operate under stringent institutional frameworks and scrutiny in decision-making, necessitating cautious consideration for the use of public funds and risk mitigation, thereby limiting their investment in innovation and capacity in risk-taking. In contrast, private enterprises are more responsive to market signals, showcasing greater flexibility and advancement in innovation. Meanwhile with their own capital at stake, the private enterprises bear the consequences and potential losses of taking risks to invest in innovation, which in turn brings stronger impetus for success. Therefore, in a market economy, private enterprises exhibit exceptional performance, particularly in high-tech industries.

Despite their significant role in the economy, large enterprises often face disadvantages in the market competition, especially with respect to financing, market access, and policy support. It is important to take a dialectical view of these realities and not adopt policies to suppress private enterprises. The future of China's economy lies in fair policies and programs that foster the development of private enterprises rather than transforming them into SOEs.

Navigating Through the Economic Challenges: Insights and Prospects

The biggest economic challenge that China faces at the moment is the insufficient demand which has led to a slowdown in economic growth. This situation is not the result of a single factor, but stems from multiple causes such as the impact of the pandemic on the industrial chain, unemployment and decreased expectations for income growth. However, stimulating demand has become particularly difficult in the current economic cycle. Hence, adept management during economic downturns is crucial for China. The government plays a key role in boosting demand, especially when private demand is insufficient, and government demand can serve as a supplement. Yet, inadequate future expectations among businesses and residents are also significant contributors to weak demands. Under such circumstances, the government should take more targeted measures to invigorate overall demand rather than just stimulate consumption. Addressing these challenges requires government wisdom and strategies to effectively manage cyclical economic fluctuations, and more importantly to guide the economy safely through downturns.

As for the future of the Chinese economy, international opinion suggests China might echo Japan's "lost 30 years". However, differences emerge when comparing the two, such as China’s current urbanization rate and overall economic development, and that of Japan in 1991. Japan was already a highly developed economy in 1991 with an urbanization rate of 77.4%, while China is currently at 65.4%. Therefore, China is still in a relatively stable growth phase rather than a continuous decline. Additionally, in terms of government debt ratios, the total debt ratios of China's central and local governments are similar to those of Japan's in those years, but China has huge amount of state-owned assets and a lower gearing ratio, which will provide more room to boost the economy once state-owned assets are utilized. Last but not least, the vigilance of China towards debt risks in both the financial and residential sectors far surpasses that of Japan during the corresponding period.

As a developing country, short-term economic fluctuations are normal. Although China is currently experiencing a downturn, it doesn't indicate the start of a long-term slump but is most likely a short-term fluctuation.

The 2023 Global Chinese Economic & Technology Summit

Information

Information

The World Chinese Economic Summit was founded by Tan Sri Lee Kim Yew and Tan Sri Michael Yeoh in 2009. It was first held in the Palace of the Golden Horses, Malaysia and hosted by its Founder and Patron, Tan Sri Lee Kim Yew.

Since then, WCES has been held in Melbourne, Chongqing, London, Melaka, Macao, Beijing, Bonn, and Penang. The Summit emphasized the role of the Global Chinese and connecting the Global Chinese Diaspora as well as promoting learning between East and West.

Resulting from the Global Pandemic and focusing on global recovery, the importance of global partnership, global leadership and global cooperation is imperative. Technology has also become a game changer and a key driver of the global economy – digital technology and innovations, green technology, health technology and agrotechnology will enhance global growth. The growing focus on sustainability also requires technological innovations and solutions.Recognizing these strategic trends of global geopolitical and geoeconomics forces and the power of global partnerships in this new global era, the WCES has been transformed into the Global Chinese Economic and Technology Summit to strive towards sustainable globalization.

China Development Institute has been working closely with the World Chinese Economic Forum committee and co-organize the series of events since 2011. The series has been an essential platform that not only provides practical insights for business and public policy leaders, but also an opportunity for the members of global Chinese community to gather together and exchange ideas.

Date: Nov 6-7, 2023

Hosts: China Development Institute and KSI Strategic Institute for Asia Pacific

Venue: CDI Mansion and Shangri-La, Shenzhen

Governor of the Hungarian National Bank Dr. György Matolcsy Visits CDI

During his visit to China, Dr. György Matolcsy, Governor of the Hungarian National Bank (MNB) and former Minister of National Economy of Hungary, visited CDI on Oct 31, 2023.

Although the global economy has been largely affected by geopolitical tensions and growth slowed, the overall economic development is observed to has been following pervious cycles. Both parties agreed that it is critical for economies to remain vigilant and aware of the global economic cycle while preparing and utilizing policy tools for mitigation. CDI experts also briefly introduced the development of Guangdong-Hong Kong-Macao Greater Bay Area and China’s financial sector.

CDI Delegation Visits Belgium and Hungarian Think Tanks and Financial Institutions

From Sept 16 to 23, 2023, CDI delegation led by Dr. Guo Wanda, Executive Vice President of CDI, visited Belgium and Hungarian think tanks and financial institutions, including Bruegel, European Policy Centre, EGMONT-Royal Institute of International Relations, KBC Group, Hungarian National Bank, Institute of World Economics of the Hungarian Academy of Sciences and China-CEE Institute. During the meetings, CDI delegates and the hosts exchanged views and insights on the global economic outlook, Chinese economic prospects, as well as Sino-EU economic and trade relationship trends.

Cao Zhongxiong

Dr. Cao Zhongxiong is the Assistant President of the China Development Institute and the Director of the Digital Strategy and Economic Research Center. He is also the expert in the economic group of Shenzhen Pioneering Demonstration Zone for Socialism with Chinese Characteristics, the consulting expert to the Legislative Committee of the Shenzhen Municipal People’s Congress, and the Deputy Secretary-General of the Shenzhen Association of Applied Economics.

Dr. Cao’s research focuses on the digital economy. He has led and participated in over one hundred consulting and planning projects for Chinese governments at all levels, as well as Alibaba, Tencent, and other leading digital economy companies. His published research report includes China's Digital Road, Platform Economy Health Index, Shared Innovation-Creating the World's Top Science and Technology Innovation Bay Area, etc.