2021 - Insights

Author: Guo Wanda, Executive Vice President of CDI

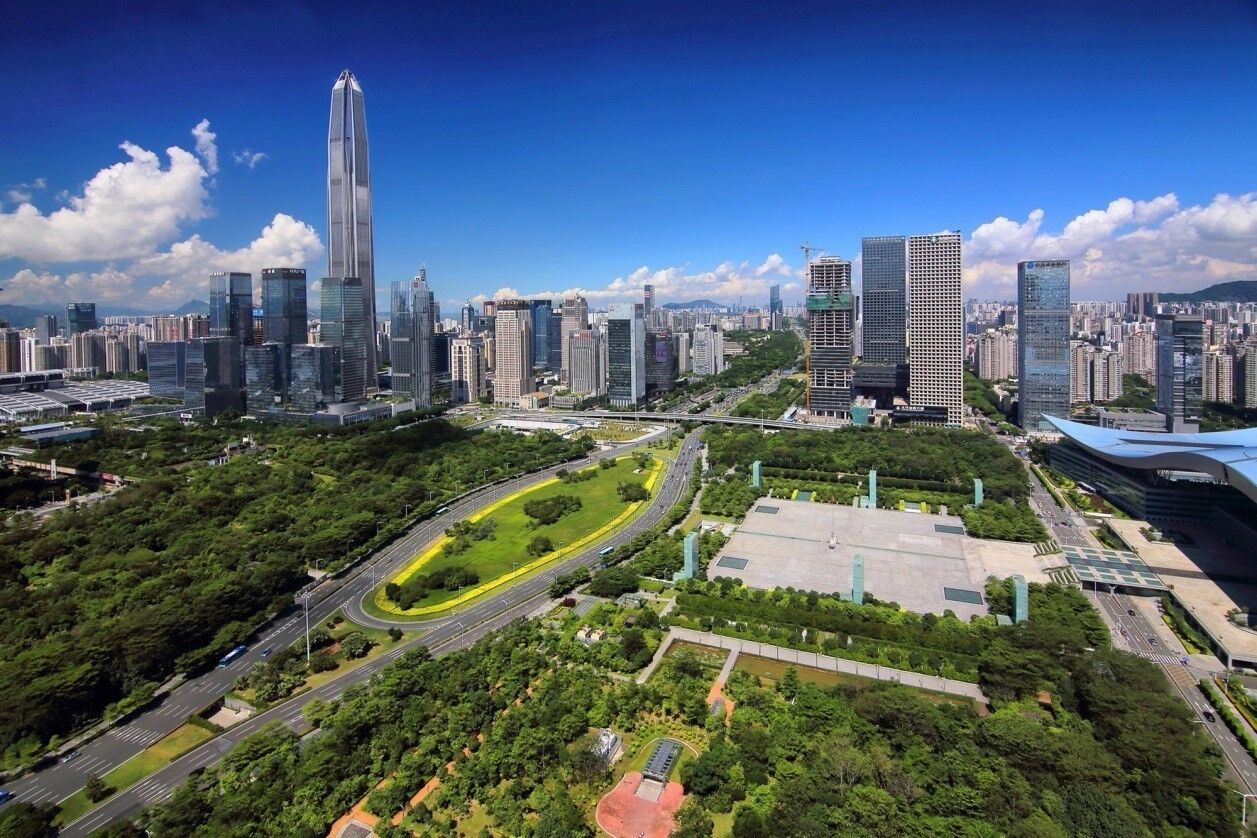

Editor’s note: Shenzhen Guangming Science City, which initially covered just 10 square kilometres, now covers close to 100 sq km and has become a key centre for China’s comprehensive national science programme due to its important role in Shenzhen’s high-quality development. Dr. Guo Wanda, Executive Vice President of China Development Institute, provided some insights into Shenzhen’s high-quality development, using Guangming Science City as an example.

High-quality development implies the adoption of higher standards and tougher requirements than standard processes, which in turn warrant a transition from investment-driven to innovation-driven development. Guangming Science City exemplifies the new model of innovation-driven development, thanks to its integration of basic scientific research and applied scientific development. Such development has been advanced through the convergence of industry, innovation, investment, and policy, allowing the construction of modern industrial systems, the reform of older systems and mechanisms, and the construction of open and inclusive innovation methods.

High-quality development also requires new development phases, new development values, and new development patterns:

- Four decades after its “reform and opening-up”, China has transitioned from a traditional production factor intensive economy to a knowledge and science-based production factor intensive development phase.

- The main development value is now the idea of being people-centred, in a population that aspires to live better, higher quality lives.

- In addition, high-quality development is a prerequisite for smooth “internal and external dual circulation” – the new development pattern that was recently proposed by the central government.

The following four types of dynamics have been critical to Shenzhen’s dedication to high-quality development; they may thus also serve as lessons and inspirations for the rest of the country:

- The dynamics between the government and the market.

The market is the main driver of growth, which makes it important to let the market play its pivotal role of resource allocation effectively. The government can, however, achieve systemic innovation to better serve as a facilitator of technological innovation, with the former being the precursor of the latter.

- The dynamics between basic science research and industrial innovation.

Guangming Science City offers an example of basic science research, which requires government investment and guidance, propelling industrial development by means of research applications developed through interaction and collaboration among large-scale science facilities, universities, R&D institutions, and top-tier private companies.

- The dynamics between “opening-up” and independent research.

Key technologies cannot be given or bought, instead needing to be developed through independent research; however, this does not mean working behind closed doors, but instead adhering to the principals of opening-up by attracting world-leading scientists and researchers.

- The dynamics between talent and innovation.

Innovation and development both require human resources. A welcoming working environment equipped with proper resources and incentives will attract and retain the appropriate talent, as well as allowing the maximisation of their creativity and innovation to achieve the organic integration of talent, innovation, and industry.

Author: Xiao Geng, Chairman of the Hong Kong Institution for International Finance, and Professor of Peking University HSBC Business School

Editor’s note: During the launch of Global Financial Centres Index 29 on March 17, 2021, Professor Xiao Geng spoke about the global financial scene and the financial connections within the Guangdong-Hong Kong-Macao Greater Bay Area (GBA).

On the greatest opportunities and challenges facing the global economy and finance in 2021

2020 was an extremely tough year for both China and the United States. China withstood the test of the pandemic and the US-Sino trade conflict, while the United States also went through the pandemic as well as election chaos and social problems induced by political division. If the social, economic, and financial conditions of either of these two countries continue to deteriorate, it will be detrimental to both the global economy and to global finance.

In the next few months, China and the United States will continue to negotiate. Competition is inevitable between the two countries, but the confrontation needs to be managed and controlled. Meanwhile, the two nations should continue to cooperate on dealing with climate change and the COVID-19 pandemic, as well as regional and global governance issues. Professor Xiao believes that the biggest challenge of 2021 willbe to explore new, more complex, and more pragmatic ways for the super-powers to cooperate, compete and coexist. He also believes this will be the new normal and the basis for the future world’s peace and prosperity.

On how the global economic and financial risk structure has shifted

The monetary policy of United States is widely thought to be irresponsible, including the fiscal expansion policy supported by zero interest rates and printingmoney. Professor Xiao proposes that there are two sides to this story. This policy has given the U.S. economic and social stability, which has benefitedboth the U.S. and the rest of the world. However, it also causes significant uncertainty for the U.S. financial market, as well as the global financial market, as the value of assets theoretically cannot be determined with zero interest rates. Asian countries in particular should be prepared as they will be on the forefront of any global financial market turbulence, because theyhave the most foreign exchange reserves and their currencies are closely linked to the U.S. dollar.

On how inflation expectations will be influenced

Regarding inflation expectations, it is important to distinguish between asset price and consumer price. The consumer price index (CPI) is expected to be controllable in 2021, partly because of China’s great impact on the price of products manufactured globally. Compared to other countries, China’s supply capacity is less affected by the pandemic and has even been improvedvia supply-side structural reforms. China thus has a defining effect on the price of global manufacturing products.

Furthermore, the CPI may not necessarily reflect inflation expectations. Inflation is mainly reflected by the revaluation of assets. China’s net wealth has increased much faster than its GDP growth over the past few yearsbecause China’s marketization has led to asset and exchange rate appreciation. This trend is in line with economic laws. However, it should be noted that some assets have not increased in value.The market decides the value of an asset. The valuation of some high-quality assets thus rose while other fell, including the valuationsof real estate and stocks. The funds released by COVID-19stimulus and relief measures were more likely to flow to high-quality assets. High-quality assets around the world have therefore been revalued, including those in the United States and China. It is therefore important to have a clear understanding of the market, and to revalue the assets in conformity with market trends.

On the development of GBA financial ecosystem

It is important to move quickly to explore how Hong Kong’s mature offshore financial system and the overall ecosystem can be extended to GBA, as this is a time-sensitive issue. This innovative approach, based on the “one country two systems” principle, will allow Hong Kong’s primary financial institutes and enterprises to operate under local supervision using Hong Kong’s common law and currency within the GBA trial zones. It will also be instrumental to overcome the protection towards industries and monopoly seen in Hong Kong, as well asto make up for its limited physical space and market. Further research is thus required into the connectionbetween Hong Kong and Shenzhen markets with the goal of building a unified market in the GBA.

Professor Xiao suggests that, as the conduit of “internal circulation” and “external circulation”, Hong Kong’s strength in market and economic openness should be combined with the GBA’s advantages in market scale, production resources and its local government’s ability to coordinate resources and centralize execution. Although Shenzhen and Hong Kong compete with each other as financial centres, the two are within the same financial cluster equipped with two distinct functions – offshore and onshore. Both functions require a unified and interconnected market so that maximum efficiency of fund, talent and land usage can be achieved. Nevertheless, offshore and onshore functions need to be separated to avoid any financial or systemic impact that the two cities could have on each other. Professor Xiao argues that this is now indeedfeasible with existing financial supervision technology.

Author: Man Nga Ching, Vice Director, Department of Hong Kong, Macao and Regional Development

Editor’s note: February 18, 2021 marks the two-year anniversary of the announcement of the Outline Development Plan for the Guangdong-Hong Kong-Macao Greater Bay Area. The Guangdong-Hong Kong-Macao Greater Bay Area (GBA) cities have been exploring inter-city comprehensive regulatory and systematic integration within the framework of the existing legal system. While fruitful progress has been made, at the same time there is room for optimization.

Top-level design: build an innovative policy system under the “one country two systems” principle

Key projects such as Qianhai (of Shenzhen city), Nansha (of Guangzhou city), and Hengqing (of Zhuhai city) have made significant progress towards GBA cooperation. However, some aspects require improvement, namely the extent of inter-city cooperation, policy making and GBA’s systematic integration. A comprehensive policy system that addresses and legally facilitates regulatory and systematic integration, the exchange of resources, and the integration of livelihoods should be built to deepen GBA cooperation under the “one country two systems” principle. The varying features and development strengths of the different GBA projects should also be considered. For instance, in the Luohu Pilot Area, Shenzhen, integration of livelihoods can be enhanced via the exploration and implementation of citizen treatment policy for Hong Kong and Macao residents.

Making Breakthroughs: Promoting the establishment of a well-connected civil and commercial judicial system in the Greater Bay Area

Over the past 40 years of reform and opening-up, and especially since the return of Hong Kong and Macao, the judicial assistance system in civil and commercial matters across Hong Kong, Macao and the Chinese mainland has been gradually improved, however, witha number of outstanding issues, such as time-consuming and difficulty with coordination and implementation.

The effective economic operation of the GBA depends on the creation of an efficient and comprehensive civil and commercial dispute resolution mechanism across the region. With the GBA’s growing market interconnectedness, the number of cross-regional legal disputes will also inevitably grow. Promoting the establishment of a well-connected civil and commercial judicial assistance system across the area is thus critical for the development of the GBA. This will also be a cost-effective approach towards regulatory and systematic integration without unifying superordinate laws or national rules. By deepening mutual legal assistance and law enforcement cooperation, the judgments in civil and commercial matters between the different legal systems in Guangdong, Hong Kong and Macao can be better coordinated, communicated and circulated. This will provide a good judicial environment for the efficient economic operation of the GBA.

Under the principle of “one country, two systems”, the GBA should strengthen the mechanism and arrangement of civil and commercial judicial assistance, facilitate the mutual recognition and enforcement of arbitration awards, and establish a convenient enforcement procedure for arbitration awards as well as civil and commercial judgments. These works should be conducted on the basis of seeking common ground while shelving differences within GBA cities, tackling easier issues first and focusing on key issues, so as to promote the establishment of a closer and more integrated civil and commercial judicial assistance system.

Starting point: Give full play to the comprehensive pilot reform authorization in Shenzhen

This reform is characterised by its openness, flexibility and adaptability. The first issue of forty authorized matters and the Implementation Plan (2020-2025) for Comprehensive Pilot Reform in Shenzhen to Build the City into a Pilot Demonstration Zone for Socialism with Chinese Characteristics have been issued. The authorized list delegated greater legislative power to the Shenzhen special economic zone and granted Shenzhen the right to take precedence in the fields of artificial intelligence, self-driving cars, unmanned aircraft, big data, biomedicine, medical health, information services, personal bankruptcy act. Some of these areas are industries closely related to those that Hong Kong has an advantage in (e.g., unmanned aircraft).

Furthermore, the authorized list leaves us with the question of whether the legislative power of Shenzhen special economic zone could be used to better connect Shenzhen and Hong Kong with the development of specific industries while breaking through the regulatory barriers in the construction of the Shenzhen-Hong Kong cooperation parks. It is suggested that the comprehensive authorized pilot reform in Shenzhen could become a critical starting point to promote the comprehensive connection between Shenzhen and Hong Kong regulations. Shenzhen’s experience can be taken as an example to be replicated and promoted. In the future, the existing policy practices and convergence regulations shall be summarized and upgraded into legislation, increasing the effectiveness while balancing the flexibility of the comprehensive authorization with the stability of local legislation.

Author: Cao Yuanzheng, Member of the Board at CDI and Chairman of BOCI Research Limited

Creating new demand is a pressing task for China

Labor productivity has been declining since the turn of the century around the world, especially in developed countries. As major technological breakthroughs are hard to achieve, the global economy has entered a new phase that requires the creation of new demand from the new round of technological revolution.

In China, considering demand-supply management from the perspective of the dual-circulation development paradigm, the focus should be on promoting the growth of people's income, especially the income of the low and lower-middle income groups. In the medium term, the focus should be increasing both government and private investment on social infrastructure, such as education and healthcare, laying a solid foundation for the domestic circulation of the new development paradigm. In the long run, the focus should be constantly creating new demand in low-carbon technology field to achieve green development, so as to let domestic circulation be the engine of the dual-circulation development paradigm.

As the tide of globalization grew in strength, China grabbed the opportunities it presented and became the world's largest export-oriented economy. However, as the Chinese economy further expands and industrial upgrading advances, the country is confronted with the same challenge as the global economy.

The long-term downturn of the global economy entails an absolute surplus in Chinese production capacity. Creating new demand is a pressing task for China as well as a global issue. Without new demand, the world might witness prevailing protectionism that benefits one at the expense of others. A salient example is the Sino-US economic and trade conflict which was just an outcome of US protectionist policies. Even the adoption of extremely loose fiscal policy and monetary policy has done little to stimulate demand, while sending asset prices skyrocketing.

In this context, the only way out is to create new demand. Green development can create enormous market demand not only in investment but also in consumption. According to estimates by the International Renewable Energy Agency, every dollar of investment in renewable energy will get eight dollars in return. The transformation of the global energy structure will increase global GDP by $100 trillion and double the number of employment positions in relevant industries by 2050.

China formally joined the Paris Agreement in 2016 and announced in 2020 that it will strive to peak its carbon dioxide emissions before 2030 and achieve carbon neutrality before 2060. To achieve the goal of keeping the global temperature rise well below 2 C above pre-industrial levels, a total of 100 trillion yuan ($15.5 trillion) of investment is needed for China's energy mix transformation by 2050, and the amount will reach 138 trillion yuan if the goal is well below 1.5 C above pre-industrial levels.

It's worth noting that compared with high-tech products such as chips, China has no technological generation gap with the developed nations in technological support for green development, therefore it can play a leading role. Green development requires revolutionary changes both in production patterns and people's lifestyles. Green development therefore should become the new direction and focus of demand-side management.

Domestically, China has just completed the building of a moderately prosperous society in all respects. Although China has eradicated absolute poverty, the low and lower-middle income groups-with a combined population of nearly 1 billion-still account for the bulk of the country's total population, a big difference from that in developed nations. Therefore, increasing the incomes of the low and lower-middle income groups should be put on top of the agenda in demand-side management before 2035.

To this end, accelerating urbanization by giving rural residents more job opportunities in cities is one of the most effective means, which has been proven by the experience of more than 40 years of reform and opening-up. The service sector has become China's largest industry alongside rapid urbanization over the past decade, which has led to the rapid growth of new job opportunities in cities. In 2010, an additional 1 percentage point of GDP growth could result in a net gain of up to 1.2 million jobs in China while now it could result in 2 million new jobs. The ever-increasing demand for labor force promoted a continuous increase in minimum wage in all provinces. Therefore, over the past 10 years, the growth rate of per capita disposable income in China's rural areas-reaching as high as 10 percent in some years-has been higher than the GDP growth rate during the same period.

During the 14th Five-Year Plan period (2021-25), on the one hand, China should quicken the process of urbanization to create more job opportunities to increase migrant workers' disposable incomes and reform rural land-use and ownership policies to increase their property incomes. On the other hand, the new focus on demand-side management will mean greater efforts to address difficult structural issues, such as fairer income distribution and improving the social safety net, to tap their spending power.

In the meantime, compared with the low and lower-middle income groups, China's higher-middle to high income groups, whose combined population has surpassed 400 million, has strong consumption power. What these groups need are high-quality services, such as children's education, medical and healthcare and elderly care services. Given that the population of this group has exceeded the US population and is expected to double within the upcoming 15 years to reach 800 to 900 million, exceeding the combined population of Europe, the US and Japan, China will become the country with the largest middle-income group by then.

Last but not least, demand-side management should also include measures aimed at stabilizing foreign trade and foreign investment. The Chinese economy has been deeply integrated into the world economy, with more intertwined interests than ever before. The Chinese market cannot be separated from the international market and external circulation could boost domestic circulation. This should be an important aspect of demand-side management.