Private Enterprises Incorporated Into SOE Operation Mechanism: an Unfavorable Trend

Author: Fan Gang, President of CDI

Author: Fan Gang, President of CDI

Editor’s Note: After acquiring the shares of private enterprises, large state-owned capital tends to operate private enterprises with SOE management mechanisms. This practice undermines economic flexibility.

In recent years, state-owned enterprises have become less energetic. New regulations set up in the national anti-corruption campaign have put SOEs under more rigorous supervision, resulting in slower decision-making process and less capacity for risks. Thus the government shall consider how to further develop the private economy. The next round of economic growth needs to be underpinned by independent innovation, which inevitably comes with huge risks. Compared to SOEs, the private sector is energetic and more willing to take risks. A risk-taking spirit coupled with a good decision-making mechanism is prerequisites for fully realizing independent innovation and market flexibility to inject vigor into economic development.

Despite a lot of support given by the central government in legislation and policies to the private sector to protect their interest and create a more enabling business environment, the operation mechanisms of private enterprises are often incorporated into SOE management after their shares are acquired by state-owned capital. Although capital has remained unchanged in the short term, this practice represents an unfavorable trend in the long run as it undermines economic flexibility. To better utilize state-owned capital to serve the private sector, the preferred stocks are desirable as they allows SOEs to invest in private enterprises for profit without imposing their own management system on the latter. In this way, private enterprises can maintain their vigor while assuming risks by themselves.

New Economy: Stronger Driver for Shenzhen's Economy Development

On November 1, European and American Investment Finance Group visited our institute. Mr. Zhou Shunbo, executive director of New Economy Institute had a roundtable discussion with the group on the issues of the status quo and prospects of Shenzhen's new economy industry development. During the discussion, Zhou Shunbo gave a detailed introduction to the role of the new economy industry in promoting Shenzhen's economic development and emphasized on the key force of digital economy in driving the social development and technology change.

On November 1, European and American Investment Finance Group visited our institute. Mr. Zhou Shunbo, executive director of New Economy Institute had a roundtable discussion with the group on the issues of the status quo and prospects of Shenzhen's new economy industry development. During the discussion, Zhou Shunbo gave a detailed introduction to the role of the new economy industry in promoting Shenzhen's economic development and emphasized on the key force of digital economy in driving the social development and technology change.

On Bay Area in China and US

Information

CDI and Bay Area Council co-organized the dialogue between the Guangdong-Hong Kong-Macau Greater Bay Area and San Francisco Bay Area which discussed the potential cooperation fields for the two bay areas.

CDI and Bay Area Council co-organized the dialogue between the Guangdong-Hong Kong-Macau Greater Bay Area and San Francisco Bay Area which discussed the potential cooperation fields for the two bay areas.

Date: November 9, 2018

Venue: Room 101, CDI Mansion, Shenzhen

Host: CDI

Theme: On Bay Areas in China and US

On China-Japan Cooperation for Win-Win Benefits

Information

Date: October 30, 2018

Venue: Room 101, CDI Mansion, Shenzhen

Host: CDI

Theme: On China-Japan Cooperation for Win-Win Benefits

FDI Keeps Flowing In

Growth slowed in Q3, though it remained in a stable zone, with GDP expanding 6.5% y/y, down 0.3 pps from H1. Though the most uncertain factor is the U.S.-China trade war, trade is booming: in Q3, exports were up 10.3% y/y, and up 7 pps from Q2. Imports were up 19% y/y, up 8 pps from Q2. Trade also comprises a very small share of Chinese GDP, and we are still optimistic that H2 growth will be stable.

Growth slowed in Q3, though it remained in a stable zone, with GDP expanding 6.5% y/y, down 0.3 pps from H1. Though the most uncertain factor is the U.S.-China trade war, trade is booming: in Q3, exports were up 10.3% y/y, and up 7 pps from Q2. Imports were up 19% y/y, up 8 pps from Q2. Trade also comprises a very small share of Chinese GDP, and we are still optimistic that H2 growth will be stable.

Industrial output was up 6% y/y in Q3, down 0.7 pps from H1. Moreover, it rose 5.8% y/y in September, close to a historical low. Fixed asset investment was up 4.5% y/y, down 0.7 pps from Q2, and down -0.9% y/y in real terms. However, for different months, investment growth rates show promising increasing patterns. In particular, investment rose 4.1% y/y in August, up 1.1 pps from July. It increased further, by 6% y/y, in September. But it’s still early to forecast that investment growth is turning firmly upward.

Consumption is stable. Retail sales of social consumption goods were up 9% y/y in nominal terms, the same rate as in Q2, and up 6.5% y/y in real terms, down 0.8 pps from Q2.

CPI was up 2.5% y/y in September, after rising for four consecutive months, and up 0.7 pps from May. CPI growth reached a new high since 2014, if we exempt the Spring Festival (New Year) season. The ex-factory price index of industrial products and PPI rose 3.6% and 4.2% y/y, down 0.5 and 0.6 pps from August respectively. However, both CPI and producer prices are expected to have growth limits, due to still-low money supply. In particular, M2 was up 8.2% y/y, basically stable since March. M1 was up 4% y/y, and has not shown signs of rebounding since the big 1.2 pps drop in August.

Despite the trade war between the United States and China, China overtook the United States to become top spot for foreign direct investment globally in H1 2018, with investment up 6% y/y to $70 billion. On October 17th, Bridgewater Associates, the world’s largest hedge fund, registered its first private securities fund in China. Its chief investment officer talks about shifting investment to Asia, and to China in particular. Based on these data, and on anecdotal information, we still have confidence in China. Investors, whether in the financial or real sectors, cannot ignore China’s three key advantages: world-class infrastructure, an educated and still-cheap labor force and most of all, the country’s scale: China is potentially the world’s largest market.

China-Pacific Islands Maritime Economic Seminar

Information

The China-Pacific Islands cooperation on marine ecological conservation, blue economy, maritime security, marine technological innovation and maritime governance has yielded early results under the framework of the 21st Century Maritime Silk Road. In order to improve infrastructure, create employment, alleviate poverty and achieve sustainable development, China and the Pacific Islands should synergize their development strategies and deepen the maritime economic cooperation while advocating the principles of equal negotiation, joint development and benefits sharing.

The China-Pacific Islands cooperation on marine ecological conservation, blue economy, maritime security, marine technological innovation and maritime governance has yielded early results under the framework of the 21st Century Maritime Silk Road. In order to improve infrastructure, create employment, alleviate poverty and achieve sustainable development, China and the Pacific Islands should synergize their development strategies and deepen the maritime economic cooperation while advocating the principles of equal negotiation, joint development and benefits sharing.

Date: September 27, 2018

Venue: Cliff Rainbow Hotel, Kolonia, Pohnpei, Federated States of Micronesia

Organized by: China Development Institute and China-Pacific Islands Economic and Culture Association

Supported by: Government of Federated States of Micronesia

Theme: Win-Win Cooperation and Shared Growth

Bridging Information Gap: First Step to Boost China-India Collaboration in Pharmaceutical Sector

On October 10, CDI delegation visited Shanghai Representative Office of Confederation of Indian Industry (CII) and discussed way forward for China-India collaboration in key areas such as pharmaceuticals and health care sector with Mr. Madhav Sharma, Head, Greater China & Chief Representative, CII.

Mr. Madhav Sharma pointed out that Indian pharmaceutical companies have access to Chinese market; however, the major obstacle is information gap. It is difficult for Indian enterprises to understand Chinese market because policy updates in English are unavailable. He suggested that CII and CDI do joint research to bridge the information gap.

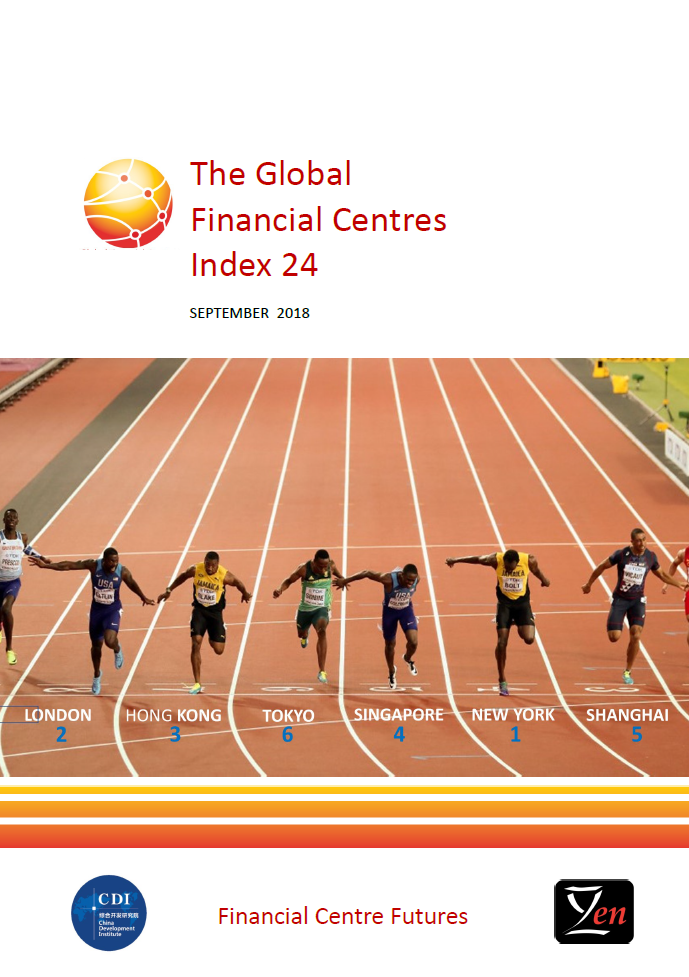

The Global Financial Centres Index 24 (GFCI 24)

Z/Yen Partners and CDI jointly released the twenty-fourth Global Financial Centres Index (GFCI 24) in Guangzhou on September 12.

The GFCI researches 110 financial centres in this edition, with 100 in the main index and 10 in the waiting list. Performance across the index is mixed.

New York took first place in the index, just two points head of London, although both centres fell slightly in the ratings. Hong Kong is now only three points behind London. Shanghai overtook Tokyo to move into fifth place. Beijing, Zurich, and Frankfurt moved into the top ten centres, replacing Toronto, Boston, and San Francisco.

There are 9 financial centres across the Chinese mainland in the main index. Among them, Shanghai rose to the 6th place. Ranking 8th, Beijings moved into the top 10 for the first time. Shenzhen and Guangzhou rose 6 and 9 places respectively and both of them are in the top 20 list. Chengdu rose to 79th place. The newcomer Hangzhou ranks at the 89th place.

Professor Michael Mainelli, Executive Chairman of Z/Yen Group, said “financial centres can, and do, control large amounts of their destiny. GFCI 24 shows the wide range of strategy, competition, specialisation, and, may I say, style in which they do it.”

Liu Guohong, Director of Finance and Modern Industry Department of CDI, said “the number and ratings of financial centres in the Greater China region increasd in the GFCI 24. The cluster of financial centres led by Hong Kong is on the rise. More systematic integration among the financial centres, which means each with a specific role, implies a strong competitive edge compared with European and North American financial centres.”

Renewable Energy: Way out of Energy Crisis for FSM

Governor Marcelo Peterson briefed strategic plans for the FSM aquaculture, agriculture and tourism sectors. Aquaculture and agriculture have been highlighted by the FSM government as potential economic avenues that could meet the local demands for food and bring economic benefits including job creation and increased exports. Eco tourism, another area of potential for the FSM, has been targeted at high-end customers and emphasized environmental protection.

What’s more, the FSM is also faced with energy crisis as it heavily relies on imported fuel. With this regard, Prof. Fan Gang suggested that the FSM could consider comprehensive use of multiple renewable energy resources ranging from wind, solar to water so as to have access to affordable and reliable energy, which is vital for driving economic growth.

Private Sector: Driving Force for China-FSM Economic Cooperation

On September 26, Chinese Ambassador to the Federated States of Micronesia (FSM) met with Prof. Fan Gang, President of CDI, and they had a discussion on the China-FSM economic cooperation.

On September 26, Chinese Ambassador to the Federated States of Micronesia (FSM) met with Prof. Fan Gang, President of CDI, and they had a discussion on the China-FSM economic cooperation.

Ambassador Huang Zheng briefed on economic and social developments in the FSM and pointed out that there is a great opportunity for the China-FSM cooperation in the fields of agriculture and tourism as the two sectors have been identified as the priority areas for economic development of the FSM.

Given that the FSM government has a clear vision and favorable policies for economic development, Chinese experienced private businesses should get involved in the China-FSM economic cooperation if their business models were profitable and sustainable in the FSM,” prof. Fan Gang said.