President Fan Gang Attends Boao Forum for Asia Annual Conference 2017

President Prof. Fan Gang spoke at two sessions of the Boao Forum for Asia Annual Conference 2017 on March 25th, namely Global Economy: Moving Beyond Sub-Health and Labor Market Reform: Though, but a Must-Do.

President Prof. Fan Gang spoke at two sessions of the Boao Forum for Asia Annual Conference 2017 on March 25th, namely Global Economy: Moving Beyond Sub-Health and Labor Market Reform: Though, but a Must-Do.

In the Session 24 Global Economy: Moving Beyond Sub-Health, Prof. Fan said when dealing with economic problems, the root cause of global economic sub-health should be taken into account. Besides, he also pointed out that economic growth might not be the symbol of healthy economy. For example, the RGDP in 2007 was 14% and after the financial crisis in 2008, RGDP rose to 12% due to the stimulus policies, which was overheated and unhealthy. In the other session 28 Labor Market Reform: Though, But a Must-Do, Prof. Fan indicated that short and long term problems coexisted in China labor market. The short term problem of China labor market was excess capacity, while the long term problems involved artificial intelligence, automation, etc. In the process of capacity optimizing, a part of workers might lose their jobs. In addition, Dr. Fan also said that China’s labor market was faced with multiple serious problems. For example, Labor Law was at the cutting-edge, but labor mobility reduced and increased labor costs.

Delegation from CSIR in South Africa Visits CDI

Mr. Charles Wyeth, Business Development Manager at the Council for Scientific and Industrial Research (CISR), and Mr. Nare Mashamaite, Enterprise Development Portfolio Manager at CSIR, visited CDI on March 2, 2017. Dr. Qu Jian, Vice President of CDI, Dr. Liu Rongxin, General Director of the Department of Regional Development Planning, and Ms. Carol Feng, Director of the International Cooperation Department, held fruitful discussions with the South African delegation.

Mr. Charles Wyeth, Business Development Manager at the Council for Scientific and Industrial Research (CISR), and Mr. Nare Mashamaite, Enterprise Development Portfolio Manager at CSIR, visited CDI on March 2, 2017. Dr. Qu Jian, Vice President of CDI, Dr. Liu Rongxin, General Director of the Department of Regional Development Planning, and Ms. Carol Feng, Director of the International Cooperation Department, held fruitful discussions with the South African delegation.

Dr. Qu introduced Shenzhen’s successful experience of building special economic zones (SEZ). He pointed out that, to successfully build a SEZ, the government must coordinate such work as proposal of policies and laws, industrial planning and spatial planning, investment feasibility study, operation plan and financing plan. Only by well implementing all the work can the government foster a favorable and attractive investment environment, and he also gave practical suggestions about SEZ site selection, financing methods, management and operation . Moreover, both sides expressed interest in cooperation and intended to have further discussion on it.

MOU Signed Between CDI and The European House – Ambrosetti

President Prof. Fan Gang of CDI and Senior Partner of Ambrosetti Paolo Borzatta signed MOU on March 21, 2017. The two parties have agreed to join forces of the two think tanks in terms of China-Europe related research programs and events. The MOU will strengthen the partnership between CDI and Ambrosetti.

President Prof. Fan Gang of CDI and Senior Partner of Ambrosetti Paolo Borzatta signed MOU on March 21, 2017. The two parties have agreed to join forces of the two think tanks in terms of China-Europe related research programs and events. The MOU will strengthen the partnership between CDI and Ambrosetti.

For the fourth consecutive year, The European House - Ambrosetti has been nominated - in the "Best Private Think Tanks" category - the No. 1 Think Tank in Italy, ranking in the world top 100 independent think tanks according to the 2016 Global Go To Think Tank Index Report by the Think Tanks and Civil Societies Program (TTCSP) at the University of Pennsylvania.

Main Findings of the China Financial Centers Index (CFCI 8)

Editor’s Note: CDI updated and published CFCI 8, which examines the latest development of financial hubs on the Chinese mainland.

CFCI 8, which was released on November 4, 2016, indicates that China's financial centers have a series of new features as follows:

CFCI 8, which was released on November 4, 2016, indicates that China's financial centers have a series of new features as follows:

First, the development of financial centers has become a driving force for economic growth. Far higher than the year-on-year growth rate of GDP, the total added value of the financial industry in 31 Chinese financial centers registered an increase rate of 14.6%, accounting for 8.71% of the local GDP on average.

Second, financial innovations in free trade zones have begun to take effect in financial centers. With the further development of cross-border RMB loans, cross-border RMB settlement, two-way capital pool of the foreign currency, and centralized operation of the foreign exchange fund of multinational corporation headquarters, financial services of the financial centers have been significantly enhanced.

Third, the development of financial innovation for scientific and hi-tech industries is accelerating. For instance, scientific and technological innovation board has been started in Shanghai and financial online platforms have been built in Shenzhen to enable the smooth connection between scientific and hi-tech enterprises and credit funds.

Fourth, the innovation-driven development of the insurance industry has been promoted. The total asset of the insurance institutes in 31 financial center cities has increased from 788 million yuan to 926 million yuan, a growth rate of 18%.

The CFCI comprehensively evaluates 31 financial centers on the Chinese mainland, using 85 indicators in the four broad areas of financial industry performance, financial institutions’ competitiveness, financial market size and financial dynamics. Since it was first released in 2009, the CFCI has been updated annually.

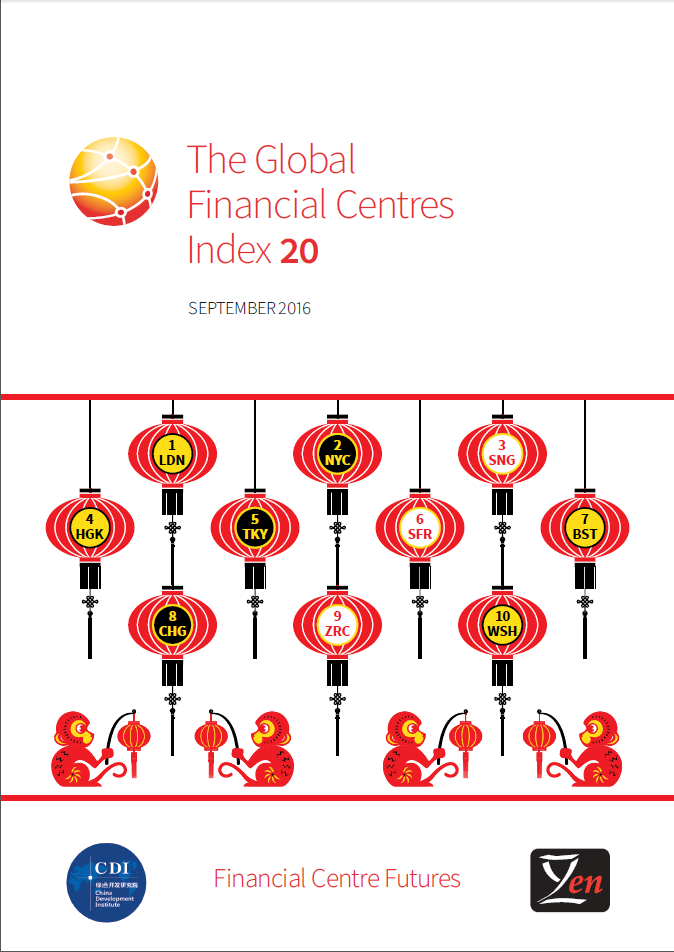

The Global Financial Centres Index 20 (GFCI 20)

Click here to download the full report as PDF.

Click here to download the full report as PDF.

London, New York, Singapore and Hong Kong remain the four leading global financial centres. On a scale of 1,000 points, a lead of fewer than 20 points indicates relative parity. London remains just ahead of New York, leading New York by 1 point. New York (2nd) is now 42 points ahead of Singapore (3rd). Singapore is four points ahead of Hong Kong (4th).

Shanghai, Shenzhen and Beijing rank as the top three financial centres on the Chinese mainland. Shanghai (16th) is 9 points ahead of Shenzhen (22nd). Shenzhen now leads Beijing (26th) by 8 points.

The GFCI provides profiles, rating and rankings for 87 financial centres, drawing on two separate sources of data - instrumental factors (five broad ‘areas’ of competitiveness, namely business environment, financial sector development, infrastructure, human capital and reputational factors) measured externally and financial centre assessments by international financial services professionals in an ongoing online questionnaire. It was first published in 2007 and then updated and republished each September and March.

Decline in China's Foreign Reserves Is Good News

Author: Fan Gang, President of CDI

Editor’s Note: “The decline in China's foreign reserves is good news in the long-run,” said Prof. Fan Gang, the President of CDI, in an interview with Bloomberg Television in Shanghai on January 9, 2017.

The decline in China's foreign reserves is good news in the long-run,” said Prof. Fan Gang, the President of CDI, in an interview with Bloomberg Television in Shanghai on January 9, 2017.

The decline in China's foreign reserves is good news in the long-run,” said Prof. Fan Gang, the President of CDI, in an interview with Bloomberg Television in Shanghai on January 9, 2017.

Much of the yuan that’s been converted into dollars hasn’t left the country, but shifted from official holdings to the private sector, according to Fan. Large foreign currency holdings by the government are deemed as less efficient. To improve efficiency, banks can use those funds to invest in higher-return assets.

China's reserves shrank by $41 billion to a fresh five-year low of $3.011 trillion in December 2016, posting the sixth straight month of declines. Capital flight has accompanied yuan’s steepest annual drop in more than two decades.

The government's moves to restrict capital outflows, which have fuelled depreciation in the yuan, are to prevent rapid fluctuations in reserves. Fan said that no government likes to see rapid changes in its foreign reserves. Instead, it prefers to see incremental changes over time. What’s more, he also said that yuan was overvalued for the last three or four years and this should be corrected.

Chinese policy makers’ intensified efforts to stem capital outflows have been effective and the market has started to respond. According to Fan, while China will not totally drop capital control measures yet, it is unlikely that they will step them up.

The inclusion of yuan in the SDR basket has made it an international currency, which means China needs to hold less foreign reserves for the purpose of international credit. “We have been talking about the inefficiency of $4 trillion in foreign reserves and the ridiculousness of a developing country financing a developed country,” Fan said.

Trump’s Anti-globalization Met with One Aye and Three Nays

Author: Peng Jian, Director of Department of Regional Development and Planning

Editor’s Note: A hawkish transition team determined to reshape global economic and trade landscape was formed upon Trump taking office. Trade war of "anti-globalization" was launched with China as the main target. The "anti-globalization" Trump’s team pushes for will face an unfavorable situation with one vote in favor and three votes against.

A hawkish transition team determined to reshape global economic and trade landscape was formed upon Trump taking office. On the one hand, the backflow in the manufacturing sector was vigorously promoted; on the other hand, trade war of "anti-globalization" was launched with China as the main target. A trade war, very likely if not inevitable, could lead to a sharp decline in China's exports to the United States, bringing about losses of 2% to China's GDP.

A hawkish transition team determined to reshape global economic and trade landscape was formed upon Trump taking office. On the one hand, the backflow in the manufacturing sector was vigorously promoted; on the other hand, trade war of "anti-globalization" was launched with China as the main target. A trade war, very likely if not inevitable, could lead to a sharp decline in China's exports to the United States, bringing about losses of 2% to China's GDP.

The "anti-globalization" Trump’s team pushes for will face an unfavorable situation with one vote in favor and three votes against. The one "yes" vote comes from the American middle and lower class, and the three "no" votes are from federal state organs, elite groups and the majority of allies.

The opposition from state organs mainly lies with the US congress. The US national debt has reached US $ 19.5 trillion, taking up 106% of its GDP, and it will soon reach the ceiling as trade war will also increase government spending. Elite group opposition is mainly seen in the military, oil, finance, high technology and other interest groups. These groups are the core strengths of the United States. Anti-globalization will place constraints on them and damage the large interests they have gathered in globalization. The majority of allies such as European countries, Japan and other allies are also against anti-globalization. The US population, technology, resources and military powers are all capable of supporting the country’s self-sustained development, while its allies are generally short of domestic market and resources, thus their sustained and safe development must rely on globalization.

China, from the inside, is one of the few countries that are potentially capable of self-sustained development other than the United States, which gives China the greatest advantage. China has pushed forward measures in military, politics and economy to respond to anti-globalization. China has always been strengthening China-Russia strategic cooperation and has maintained good strategic cooperative relations with Pakistan and Iran. Moreover, China has taken the initiative to deal with risks and bubbles at home. Decisions have been made ahead in order to cope with possible economic difficulties. From the outside, the Philippines has turned an active promoter of RCEP, and Russia's attitude towards the China-Pakistan Economic Corridor has changed from equivocal to supportive.

Judging from China’s internal and external affairs, it is at the moment impossible for China to repeat the mistake as in Plaza Accord. Therefore, China will tap the huge strategic potential of regional integration and self-sustained development to cope with anti-globalization.

Housing Supply and Demand in Big and Small Cities: Why the Difference?

Author: Fan Gang, President of CDI

Editor’s Note: The latest upsurge in land price and housing price revealed an important policy reason that it is the urbanization strategy that has caused polarization in cities. It is crucial to follow the law of population migration and urbanization to free up more land for the development in big cities.

The latest upsurge in land price and housing price revealed an important policy reason that it is the urbanization strategy that has caused polarization in cities.

The latest upsurge in land price and housing price revealed an important policy reason that it is the urbanization strategy that has caused polarization in cities.

The basic rationale of urbanization is agglomeration. The greater the agglomeration is, the more advantages it brings. Township enterprises move into big cities because costs of roads and electricity in rural areas are pretty high. By contrast, building development zones in the vicinity of cities boasts a number of advantages including lower-cost infrastructure and more convenient logistics, thus more businesses can be supported with the same amount of investment. Industrial agglomeration creates jobs and income, and thus attracts people.

Large population in big cities generates jobs in the service sector. The service sector is an outcome resulting from socialization of family life. When family life is socialized, jobs are created. Population agglomeration can create new economies as well as new knowledge. According to the knowledge spillover theory in economics, the stock of knowledge, when pooled, can proportionally produce knowledge increment. The advent of excellent schools and hospitals as well as new forms of culture in big cities is precisely the result of population agglomeration.

China currently sets a limit on the population in big cities, which means the supply of public goods, including land, is not arranged in accordance with the anticipated population influx in the future. However, it is futile to set such limits to restrict migration, for the population in big cities will soon go beyond the set limit as long as people are willing to move in. This will give rise to polarization in cities, which refers to the disparity in population flow between big and small cities. On the one hand, the population influx in large cities causes a serious imbalance between supply and demand; on the other, population outflow from small cities and towns results in supply far outstripping demand. This indicates a flaw in the urbanization policy, which goes against the law of human migration, urbanization and industrialization.

With the country in an ongoing process of rapid industrialization, population keeps migrating into cities, and yet the retired population has not reached a considerable size. Therefore, small towns that are not located within big city clusters will be facing challenges and difficulties to develop at the present stage. Some of them will probably die out with the population outflow. Yet it’s just that the prime time for development has not come for most of these towns. As a matter of fact, population outflow is also a way of development, as it is conducive to the increase of per capita income in small towns. In addition, preservation of old houses, natural environment and distinctive culture in small towns could also prepare the towns for the backflow of retired population in the future.

It is crucial to follow the law of population migration and urbanization to free up more land for the development in big cities, including the surrounding small towns. Once population concentrates in big cities, tension between supply and demand will arise in housing, transportation, public security, social security, and other public services. To crack the problems, we should make massive further adjustments, which should no longer be limited to controlling housing prices by simply imposing a property purchase limit, but also levying property taxes, increasing urban floor area ratio, reforming rural land system, and adjusting the urbanization development strategy, etc. The underlying logic of the purchase limit should be to ensure that the limited supply of housing units goes to those who are in need, not to those who speculate in real estate. Property purchase limit is not an absolute necessity as property tax can be implemented instead. Property tax boasts inherent stability, which means the higher the housing price, the higher the tax. If the property tax is high enough, rather than less than one percent in trial cities like Shanghai and Chongqing, it will eventually come into play.

Indicators Signal Good Prospects

Due to Chinese New Year, many statistics are still not available, making our analytical task more difficult. But one notable policy change is that monetary policy reversed its 2016 loosening trend, and shifted into tightening. We also expect this to be the trend for 2017. M1 rose 14.5% y/y, continuing the declining trend it began in August, decreasing 1 pps per month on average, and rising 20% y/y, after correcting for the New Year’s holiday effect. M2 rose 11.3% y/y, its lowest level since last year.

Due to Chinese New Year, many statistics are still not available, making our analytical task more difficult. But one notable policy change is that monetary policy reversed its 2016 loosening trend, and shifted into tightening. We also expect this to be the trend for 2017. M1 rose 14.5% y/y, continuing the declining trend it began in August, decreasing 1 pps per month on average, and rising 20% y/y, after correcting for the New Year’s holiday effect. M2 rose 11.3% y/y, its lowest level since last year.

Loan growth has hit a new low. Chinese yuan loans from financial institutions rose 12.6% y/y, down 2.7 pps from last January, and their lowest growth rate since June 2005. Deposits from non-financial enterprises rose 11% y/y, showing a deleveraging trend since November. Imports jumped 16.7% y/y, and were up 14 pps from Q4 2016 in January, Exports improved less, rising 7.9% y/y.

CPI rose 2.5% y/y in January or 2.3% y/y after correcting for the New Year’s effect, slightly higher than last month. Producer prices continued rising. PPI rose a rapid 6.9% y/y, and 0.8% m/m, up 1.4 pps from last December. We expect PPI to match its last peak of 7.5% y/y, seen in July 2011.

The CEEM-PMI (an abbreviation for the China External Environment Monitor PMI), an external PMI indicator recently developed by the China Academy of Social Sciences, measures China’s external economic environment. It recently rose to 53.6, above the 50 threshold, mostly in line with, but better than, the two general PMI indices, NBS PMI and HSBC PMI, which were at 51.3 and 51 respectively. While the latter two figures indicate a general economic recovery for China, the CEEM-PMI signals possible improvement of external demand. The jump of the CEEM-PMI may be mainly driven by developed markets. For example, the new high value of U.S. PMI at 56 may be interpreted as a rebound from the previous overreaction to Trump-driven trade uncertainties.

Facing the Trade Uncertainties

GDP in 2016 rose 6.7% y/y, down 0.2 pps from 2015, reaching the lowest yearly level in China. The quarterly growth was highly stable, with first three quarters rising 6.7% and the fourth quarter rising 6.8%. In 2016, fixed asset investment rose 8.1%, down 1.9 pps from 2015. From the growth trend, it rose fastest in Q1, and grew 10.7% y/y, higher than Q3 and Q4 in 2015. The other three quarters displayed slower growth rates.

GDP in 2016 rose 6.7% y/y, down 0.2 pps from 2015, reaching the lowest yearly level in China. The quarterly growth was highly stable, with first three quarters rising 6.7% and the fourth quarter rising 6.8%. In 2016, fixed asset investment rose 8.1%, down 1.9 pps from 2015. From the growth trend, it rose fastest in Q1, and grew 10.7% y/y, higher than Q3 and Q4 in 2015. The other three quarters displayed slower growth rates.

Ended on December 16, 2016, the most important meeting, the central economic workshop meeting, held by Chinese top leaders including the President and Prime Minister, states that the policies for 2017 will lean towards fiscal policy rather than monetary policy which has been loosened but effect was small. The meeting also states that housing is for living, not for speculation. We expect the housing market will cool down further and more cities will start to adopt real estate tax to beat speculation.

There was divergence between imports and exports in 2016. Total exports fell -7.7% y/y, down 4.9 pps from 2015. Instead, total imports fell -5.5% y/y, up 8.6 pps from 2015.

Producer prices have been recovering. Ex-factory price of industrial goods first turned positive growth from September in 2016, and quickly expanded to 5.5% y/y growth rate in December. PPI turned positive from October and rose 6.3% y/y eventually in December. We expect the rising producer prices will translate to higher CPI in 2017. Before July, M1 growth rate steadily increased, reaching growth rate of 25.4% y/y at its peak, but after that, M1 growth rate lowered continuously, and grew 21.4% y/y in December, and the m/m growth rate was negative after considering seasonal factors. We expect monetary policy will be neutral in 2017.

On January 27, 2017, the US newly elected president Donald J Trump stated to consider a 20% tariff on Mexican exports to US. Trump has been an advocate for trade protection during his campaign. China is definitely on the list of potential tariff increase or to be labeled as currency manipulator. However, we expect US will lose more from a potential US-China trade war. Chinese economy is more flexible and can substitute jobs with its large fiscal capability considering China’s low national debt. China also mainly plays the role of processing trade which means the negative impact will transfer to other economies. The financial market will react instantly to any trade friction and self-fulling amid the two largest economies’ conflict, which will eventually lead to resort to US dollar safe haven. A large appreciation of US dollar will hurt the US economy more.