The Global Financial Centres Index

Click here to download the full report as PDF.

On March 11, Z/Yen and CDI jointly released the twenty-fifth edition of the Global Financial Centres Index (GFCI 25) during the Global Financial Forum in Dubai.

In GFCI 25, we researched 112 centres for this edition, with 102 centres in the main index and 10 in the associate list.

GFCI 25 was compiled using 133 quantitative measures provided by third parties including the World Bank, The Economist Intelligence Unit, the OECD, and the United Nations, with the combination of 29,065 financial centre assessments provided by respondents to the GFCI online questionnaire.

New York remains in the first place in the index, just seven points ahead of London. Hong Kong is only four points behind London in third and Singapore remains in fourth place. Shanghai remains ahead of Tokyo in fifth place in the index although Tokyo gained ten points in the ratings. Toronto gained four places to seventh. Zurich, Beijing, and Frankfurt remained in the top ten.

Most Asia/Pacific Centres performed well. There has been a strong trend of Asia/Pacific centres improving over several years. The top eight centres in the region are now in the top fifteen centres in the whole index.

9 financial centres across the Chinese mainland were included in the main index, namely Shanghai, Beijing, Shenzhen, Guangzhou, Qingdao, Tianjin, Chengdu, Hangzhou and Dalian. Despite their ratings growth, Beijing, Shenzhen, Tianjin, Chengdu, and Dalian witnessed slight decrease in their rankings.

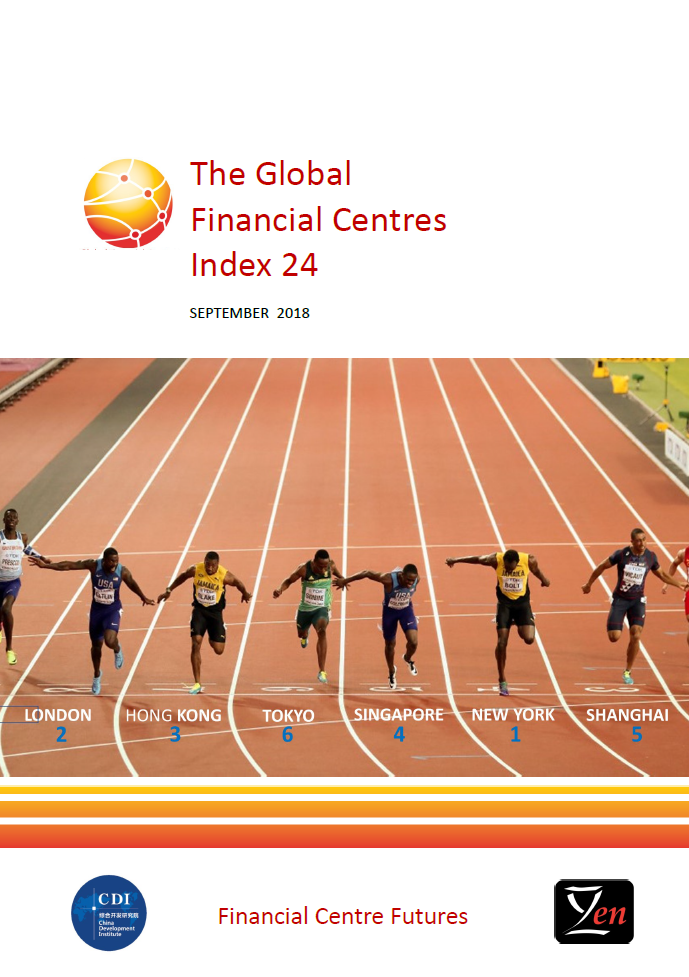

Z/Yen Partners and CDI jointly released the twenty-fourth Global Financial Centres Index (GFCI 24) in Guangzhou on September 12.

The GFCI researches 110 financial centres in this edition, with 100 in the main index and 10 in the waiting list. Performance across the index is mixed.

New York took first place in the index, just two points head of London, although both centres fell slightly in the ratings. Hong Kong is now only three points behind London. Shanghai overtook Tokyo to move into fifth place. Beijing, Zurich, and Frankfurt moved into the top ten centres, replacing Toronto, Boston, and San Francisco.

There are 9 financial centres across the Chinese mainland in the main index. Among them, Shanghai rose to the 6th place. Ranking 8th, Beijings moved into the top 10 for the first time. Shenzhen and Guangzhou rose 6 and 9 places respectively and both of them are in the top 20 list. Chengdu rose to 79th place. The newcomer Hangzhou ranks at the 89th place.

Professor Michael Mainelli, Executive Chairman of Z/Yen Group, said “financial centres can, and do, control large amounts of their destiny. GFCI 24 shows the wide range of strategy, competition, specialisation, and, may I say, style in which they do it.”

Liu Guohong, Director of Finance and Modern Industry Department of CDI, said “the number and ratings of financial centres in the Greater China region increasd in the GFCI 24. The cluster of financial centres led by Hong Kong is on the rise. More systematic integration among the financial centres, which means each with a specific role, implies a strong competitive edge compared with European and North American financial centres.”

Click here to download the full report as PDF.

Click here to download the full report as PDF.

Z/Yen Partners and CDI published the twenty-third Global Financial Centres Index (GFCI 23) on the Launch Conference which was held in Qingdao on March 26.

The GFCI rates 96 financial centres in current issue. There is an overall increase in confidence for the leading centres with the top 25 centres all rising in the ratings.

London, New York, Hong Kong, Singapore and Tokyo remain the five leading global financial centres. The gap between London and New York in ratings closed to one point on a scale of 1,000. London’s rating rose less than the other four top centres. There is now less than 50 points between the top five centres.

The number of financial centres across the Chinese mainland in the main index has increased from 7 to 8 with the addition of Tianjin from the associate centres list. Among them, Shanghai remains at the 6th place. Ranking 11th, Beijing fell slightly by one place, but the gap between Beijing and Boston, which ranks 10th, in ratings was only one point on a scale of 1,000. Shenzhen, Guangzhou, Qingdao and Chengdu rose 2, 4, 14, and 4 places respectively. The newcomer Tianjin ranks at the 63th place. Dalian continuously dropped to 96th.

Mark Yeandle, Director of Z/Yen Partners and the author of the GFCI, said "All the top centres have risen in the ratings. London remains on top despite Brexit concerns but rose less than any other centre in the top fifteen."

Zhang Jiansen, Research Director of Finance and Modern Industry Department of CDI, said "Competitiveness of the Chinese financial centres will be further unleashed with the gradual reform and opening-up of China’s financial market.

Click here to download the full report as PDF.

Click here to download the full report as PDF.

London and New York remain in first and second places. Interestingly, despite the ongoing Brexit negotiations, London only fell two points, the smallest decline in the top ten centres. Hong Kong has moved just ahead of Singapore into third – only two points ahead on a scale of 1,000. Tokyo remains in fifth.

There are seven cities across the Chinese mainland rated in the GFCI 22, namely Shanghai, Beijing, Shenzhen, Guangzhou, Qingdao, Dalian and the newcomer Chengdu. Among them, Shanghai got 711 points and ranks 6th, rising 7 places in the rankings. Beijing rose 6 places to the 10th position. Shenzhen got 689 points and ranks 20th, rising 2 places. Shanghai, Beijing ,and Shenzhen are in the top 20 financial centres. Guangzhou ranks 32nd and Qingdao ranks 47th. Chengdu, first enlisted in the GFCI rankings from the associate centres list, ranks 86th and got 604 points. Dalian fell to 92nd.

GFCI 22, jointly compiled by Z/Yen and Group CDI, was launched simultaneously in Chengdu, China and Abu Dhabi, The United Arab Emirates.

Click here to download the full report as PDF.

Click here to download the full report as PDF.

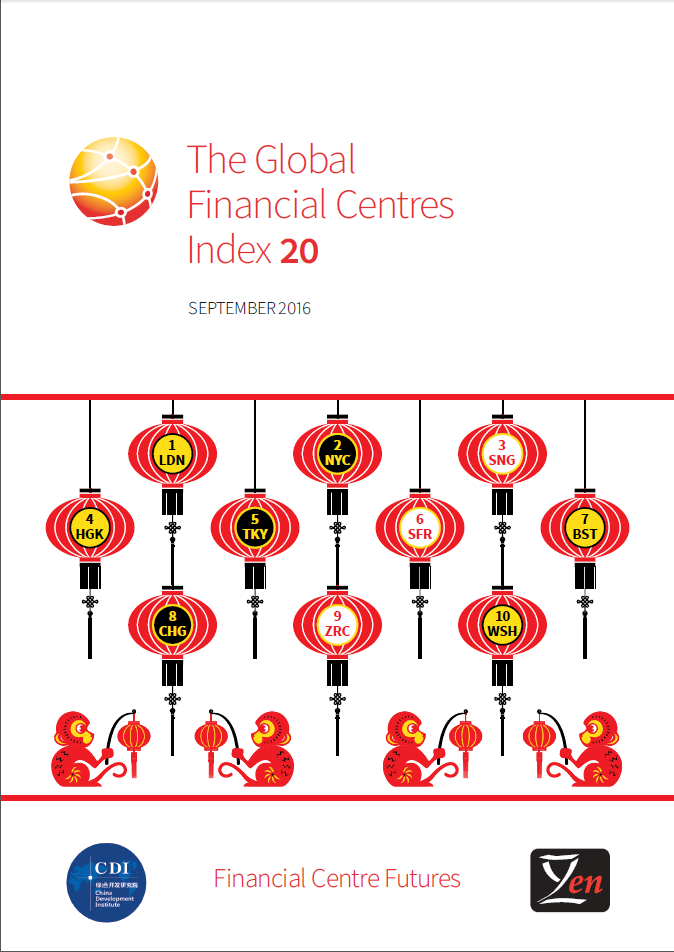

London, New York, Singapore, Hong Kong and Tokyo remain the five leading global financial centres. However, Brexit and the US election have had a significant impact. London and New York fell 13 and 14 points respectively. These are the largest declines (except for Calgary) in the top 50 financial centres. Singapore rose by eight points and is now only 20 points behind New York.

There are six cities of mainland China rated in the GFCI 21, including Shanghai, Beijing, Shenzhen, Guangzhou, Qingdao and Dalian. Shanghai got 715 points, ranks 13rd, rising 3 places in the rankings. Beijing rose significantly, rising ten places. Both Shanghai and Beijing are in the top 20 financial centres. Shenzhen got 701 points, ranks 22nd. Guangzhou has been enlisted in GFCI Index for the first time and did well with 650 points, ranks 37th. Qingdao won 640 points and ranks 8th just behind Guangzhou. Dalian fell to 75th in the rankings. Apart from that, Chengdu and Hangzhou are regarded as associate financial centres.

GFCI 21 was launched simultaneously in Milan and Shenzhen by the Z/Yen Group and CDI which marked the second collaboration between CDI and the Z/Yen on the compiling of GFCI.

Editor’s Note: CDI updated and published CFCI 8, which examines the latest development of financial hubs on the Chinese mainland.

CFCI 8, which was released on November 4, 2016, indicates that China's financial centers have a series of new features as follows:

CFCI 8, which was released on November 4, 2016, indicates that China's financial centers have a series of new features as follows:

First, the development of financial centers has become a driving force for economic growth. Far higher than the year-on-year growth rate of GDP, the total added value of the financial industry in 31 Chinese financial centers registered an increase rate of 14.6%, accounting for 8.71% of the local GDP on average.

Second, financial innovations in free trade zones have begun to take effect in financial centers. With the further development of cross-border RMB loans, cross-border RMB settlement, two-way capital pool of the foreign currency, and centralized operation of the foreign exchange fund of multinational corporation headquarters, financial services of the financial centers have been significantly enhanced.

Third, the development of financial innovation for scientific and hi-tech industries is accelerating. For instance, scientific and technological innovation board has been started in Shanghai and financial online platforms have been built in Shenzhen to enable the smooth connection between scientific and hi-tech enterprises and credit funds.

Fourth, the innovation-driven development of the insurance industry has been promoted. The total asset of the insurance institutes in 31 financial center cities has increased from 788 million yuan to 926 million yuan, a growth rate of 18%.

The CFCI comprehensively evaluates 31 financial centers on the Chinese mainland, using 85 indicators in the four broad areas of financial industry performance, financial institutions’ competitiveness, financial market size and financial dynamics. Since it was first released in 2009, the CFCI has been updated annually.

Click here to download the full report as PDF.

Click here to download the full report as PDF.

London, New York, Singapore and Hong Kong remain the four leading global financial centres. On a scale of 1,000 points, a lead of fewer than 20 points indicates relative parity. London remains just ahead of New York, leading New York by 1 point. New York (2nd) is now 42 points ahead of Singapore (3rd). Singapore is four points ahead of Hong Kong (4th).

Shanghai, Shenzhen and Beijing rank as the top three financial centres on the Chinese mainland. Shanghai (16th) is 9 points ahead of Shenzhen (22nd). Shenzhen now leads Beijing (26th) by 8 points.

The GFCI provides profiles, rating and rankings for 87 financial centres, drawing on two separate sources of data - instrumental factors (five broad ‘areas’ of competitiveness, namely business environment, financial sector development, infrastructure, human capital and reputational factors) measured externally and financial centre assessments by international financial services professionals in an ongoing online questionnaire. It was first published in 2007 and then updated and republished each September and March.