Insights

Author: Fan Gang, President of CDI

Editor’s Note: The most valuable thing of urban villages is that they provide cheap housing and living conditions for low income earners in China. The low rent in urban villages not only ensures that there is sufficient and low-cost labor supply in the city, but also actually reduces the living cost and inflation rate in the city.

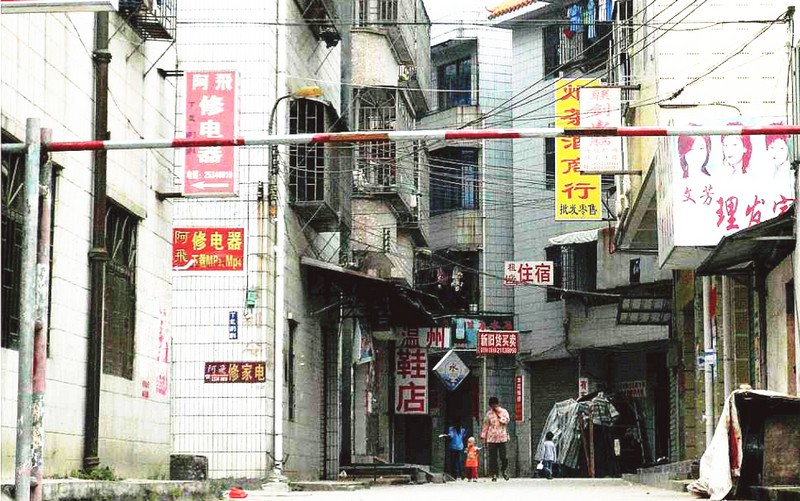

Urban villages and old towns clustered with new migrants in some cities are often regarded as an obstacle in China’s urbanization drive. People are eager to clear these eyesores as soon as possible and replace them with charming landscapes.

Urban villages and old towns clustered with new migrants in some cities are often regarded as an obstacle in China’s urbanization drive. People are eager to clear these eyesores as soon as possible and replace them with charming landscapes.

One reason is poor public security. Large numbers of migrants and low income earners make it complicated to manage the urban villages. Have we ever strengthened the management at first, have we provided necessary public facilities and services, or have urban villages been treated as an administrative region of a metropolis?

The urbanization is essentially a flow of migrants and low income earners into the city. If public services are still mainly provided for the original urban residents, the problem of government absence will definitely arise in urban villages. Usually, managing urban villages is a tough job, but it is unforgivable to leave them aside. The hard task can actually be used as the best touchstone to assess the ability of government officials.

Another annoying thing about urban villages is their unsightliness. Let’s look at Europe’s old towns in big cities, which were once urban villages in some sense. After decades or even a hundred years of evolution, they have attracted a great number of tourists with their distinct style. We can preserve some of the urban villages, get them renewed, decorate them with artistic ideas and modern architectural methodology, and build special pedestrian streets, etc., thus they can be involved into the development of modern cities. In the early days, the conditions of slums in many cities in developed countries might be even worse than those of our urban villages nowadays. We now have the ability to reconstruct the urban villages and maintain low-cost, orderly, clean, and safe living conditions for low income earners, with technologies which are far more advanced than those in the past.

Issues about urban villages involve laws and regulations, and urban management, which must be dealt with by reform. For example, how to bring out a reform which keeps the original ownership unchanged once the homestead of a farmer is classified as land for urban development, and at the same time ensures the land is uniformly treated as urban property under the laws and regulations.

The most valuable thing of urban villages is that they provide cheap housing for low income earners in China. Once these people have a house to live in, they can settle down and look for jobs in the city. The low rent in urban villages not only ensures that there is sufficient and low-cost labor supply in the city, but also actually reduces the living cost and inflation rate in the city, which is good for the overall urban stability.

Despite the fact that most urban villages are destined to be plucked down with China's industrialization and urbanization drive pushing forward, China is still at the initial stage of the urbanization. We cannot expect to immediately catch up with the urban standards of developed countries. People with relatively low income, who have newly moved to the city, will become a main part of Chinese urban residents, and even a dominant part in some emerging cities and towns, in a considerably long period. The first step towards people-friendly urbanization is to provide these people with basic living and development conditions. It is not difficult to provide elegant and comfortable modern urban conditions for a small number of rich people. The real challenge for the government is to provide basic living and development conditions for the large number of low income earners, so that they can gradually settle down and make a living in the city.

Author: Fan Gang, President of CDI

Editor’s Note: Because of the two overheatings, we have to take time handling the after-effects. If we continue reform and prevent an overheated economy, it is entirely possible that we can maintain a sound economic growth in ten to twenty years.

If we draw a trend chart for China’s economy in the past ten years, we will get two wave crests, which are “two overheatings”.

If we draw a trend chart for China’s economy in the past ten years, we will get two wave crests, which are “two overheatings”.

The first overheating appeared during 2004 and 2007. The US underwent the great real estate plus financial bubbles, resulting a overheating all over the world. China’s export volume increased by 30-40% on a yearly basis. After housing system reform, the local government tended to be keen on land finance. Enterprises invested in real estate, and so did the local government. Consequently, the economy was overheated quickly.

The second overheating lasted from 2009 to 2010. With the widespread outbreak of the global financial crisis in September 2008, China’s economy slipped badly, experiencing negative export growth. Large quantities of migrant workers returned home, and its economy was faced with the threat of a hard landing. Under this circumstance, the Chinese government launched ten measures to further expand domestic demands and boost a steady and relatively rapid growth of its economy in November. It was estimated that a total of 4 trillion yuan was invested as of the end of 2010. It was interpreted as the “4 trillion yuan stimulus package” by the foreign media. With the fast promotion of various measures, Chinese economy stopped its downhill tumble, and even realized growth against the trend which stunned the world. Within the half year from the end of the first quarter to the third quarter of 2009, the Chinese GDP growth had a rebound, growing 8.9% from the valley bottom of 6.1%. One year later, its economy began to overheat, which was obviously characterized by the explosive growth of housing price. The government turned round to throw cold water on it. In April 2010, the government issued the house purchase quota policy, continuously suppressing the growth of housing prices.

The after-effects, excess capacity in particular, continue up to now after the overheatings. Behind excess capacity stand the bad debts, and behind these debts distressed enterprises. Why did the Chinese economy tend to overheat? The most important reason lies in the local government. When the economic crisis emerged in 2009, the local government borrowed a lot of debt. More debt means more investment, and the economy began to overheat. The underlying cause is that the local government doesn’t need to control the macro variables. Inflation, asset bubble and employment all fall into the responsibilities of the central government, while the debt problem of the local government will be solved by the central government in the end. This mechanism led to a special phenomenon for the Chinese economy: If we let it be, there will be a mess; and if we handle it, it will come to a deadlock. This circulation has been under way for so many years.

We have laid a good foundation over the past ten years. But because of the two overheatings, we have to take time handling the after-effects. If we continue reform and prevent an overheated economy, it is entirely possible that we can maintain a sound economic growth in ten to twenty years. Certainly, this growth should be normal, at the growth rate of 7%, 8%, or 6%. Only when China has stepped over the stage of middle income, can it really become a great power, with its people's living standard being at the international advanced level. The most important move is the reform of the market economy system to identify the dividends as far as possible. Education development is the priority. The Chinese people have huge latent knowledge capacity. Previously, we fell far behind, we didn’t innovate, and we had to follow others. But now we have learned a lot, we are increasingly getting closer to the leading edge, there are great possibilities for us to realize true innovations.

Author: Fan Gang, President of CDI

Editor’s Note: Supply-side structural reform focuses on the “elimination of excess capacity”. In a broad sense, this means de-stocking, de-leveraging and cost reduction. It is a long-term issue which requires in-depth institutional planning and long-term adjustment.

What is supply-side reform? To put it simply, the supply side is the opposite of the demand side. On the demand side, there are three stimulating forces of the economy, investment, consumption and export. These three forces determine the short-term economic growth rate. On the supply side there are four factors, the labor force, capital, technology and regulation. In essence, it takes a long time to improve these four factors, which decide the long and mid-term potential growth rate.

What is supply-side reform? To put it simply, the supply side is the opposite of the demand side. On the demand side, there are three stimulating forces of the economy, investment, consumption and export. These three forces determine the short-term economic growth rate. On the supply side there are four factors, the labor force, capital, technology and regulation. In essence, it takes a long time to improve these four factors, which decide the long and mid-term potential growth rate.

In this sense, supply-side reform is a long-term issue which requires in-depth institutional planning and long-term adjustment. Reform is necessary whether or not the economy is good. However, the supply side also has short-term issues such as eliminating the supply surplus. Eliminating the supply surplus and releasing the excessive resources trapped inside it can improve the efficiency of resource use and promote economic growth, which is the essence of supply-side structural reform. “Zombie companies” in some regions rely on subsidies from local governments, resulting in the decline of the whole industry's supply capacity. This is the practical meaning of supply-side reform now and in the near future.

For these reasons, supply-side structural reform focuses on the “elimination of excess capacity”. In a broad sense, this means de-stocking, de-leveraging and cost reduction. The capacity would not be released and the next round of growth would not happen if such measures were not taken. Sooner or later, the Chinese economy will escape its slow performance, abnormal state and deflation, and we will definitely see the results of supply-side reform

The adjustment has an active meaning. When the economy is far too hot, all enterprises have their orders. However, when the economy is in a downward trend, enterprises that have focused on innovation of products and technologies in the past few years are presented with greater advantages, on the contrary, those enterprises that are not sufficiently professional and always think about speculations find themselves in the position of possibly being eliminated, merged or regrouped. When good resources go to good enterprises, better benefits will be generated and direct financing will play a bigger role.

We must now be fully aware of the possible mistakes of undertaking supply-side reform. Some people misunderstand reform as adding new industries and new supplies, which might result in a new surplus when the original supply surplus has not yet been eliminated. In the future economic development, we should not use new supply growth to cover past problems.

Author: Fan Gang, President of CDI

Editor’s Note: To further reform the Chinese forex system, we should not resume the system of being pegged to the USD that China adopted in the past. Instead, the RMB should be related to the currencies of a variety of nations.

At present, supply-side structural reform in China is becoming increasingly important and urgent. Some believe it is imperative to make necessary adjustments through supply-side reform because the marginal effects of monetary and fiscal policies will decrease progressively.

At present, supply-side structural reform in China is becoming increasingly important and urgent. Some believe it is imperative to make necessary adjustments through supply-side reform because the marginal effects of monetary and fiscal policies will decrease progressively.

Supply-side structural reform generally includes institutional reform, education development, innovation and industrial restructuring. These issues involve productivity improvement and long-term growth trends. Reform is often believed to be a long-term issue which cannot be solved once and for all in the short term. It is currently the most important issue in China, and it poses the greatest challenges.

Monetary policies and macro policies make short-term adjustments. When the supply is given, if a demand surplus suddenly occurs, it is often necessary to curb surplus to avoid inflation. When the demand falls short, it is imperative to make up for the shortage through macro policies.

Strictly speaking, macro policies adjust the demand side while reform polices adjust the supply side, and both of these policies are necessary. In different circumstances and at different time points, we need to use policies to stabilize demand-supply relations so as to facilitate the continuous growth of the Chinese economy. We must not replace short-term policies with long-term policies, or else the financial crisis cannot be addressed. To counter this crisis, we will have to adopt demand-side policies.

On December 1st, 2015, the IMF announced that the RMB would join the SDR on October 1st, 2016. This has been praised as a major milestone for the integration of the Chinese economy into the global financial system. Although the RMB still has a long way to go before becoming a genuine international reserve currency, this still marks the rise of China's power and stability of the Chinese currency.

To further reform the Chinese forex system, we should not resume the system of being pegged to the USD that China adopted in the past. Instead, the RMB should be related to the currencies of a variety of nations, thus encouraging more countries to use the RMB due to its reserve function and raising the international development of the RMB to a new level.

The RMB is very stable against the USD. However, the Japanese Yen and Euro have depreciated over the past few years. Furthermore, currencies in emerging economies such as the AUD and CAD have also depreciated considerably against the USD. As a result, the USD-pegged RMB has become seriously overvalued, forming expectations for RMB depreciation in the market.

The real weak point in China is direct financing. 2015 witnessed serious fluctuations in the Chinese capital market. People are calling for the stock market to be improved. At the same time, China needs more policies and legislation to secure smooth direct financing channels and the stability of financing forms. The Chinese capital market is underdeveloped. At present, direct financing only accounts for a very small proportion of the country's entire financing. In the past few years, this proportion has sometimes fallen as low as 2-3%, and it will not exceed 10% this year. However, in developed market economies, even in Germany and Japan in which banks play a very important role, direct financing accounts for 30-40% of the total financing. In the USA, the proportion is as high as 60-70%. Banks should provide indirect financing and working capital. Funds for development, including those for ownership regrouping, should be provided via direct financing, including angel funds, VC, rounds of PE and pre-IPO investment. In short, China should vigorously develop its direct financing, including private funds.