Information

A deep understanding of current global problems and their development will help us effectively address global challenges. On August 8, 2019, China Development Institute held an international symposium, where Ruchir Sharma, Chief Global Strategist at Morgan Stanley Investment Management, shared insights on "4D" problems faced by the global economy amid sluggish growth as well as future strategies for China's economy, followed by in-depth discussions.

Venue: Room 101, CDI Mansion, Shenzhen

Host: CDI

Theme: Global Economic Predicament and China's Development in the "4D" World

Program

14:30-14:35 Opening Remarks

GUO Wanda, Executive Vice President, CDI

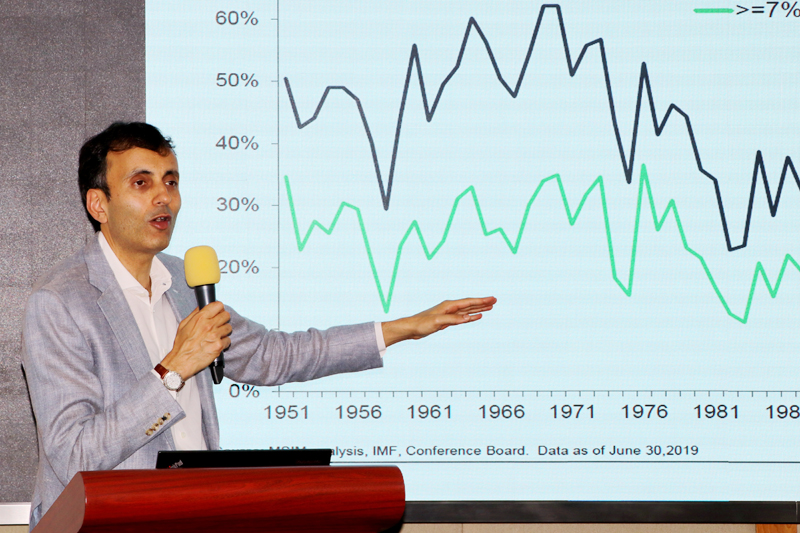

14:35-15:05 Global Economic Predicament and China's Development in the "4D" World

Ruchir SHARMA, Chief Global Strategist, Morgan Stanley Investment Management

15:05-16:15 Q&A

Highlights

- The global economy in the "4D" world of structural downturn

Depopulation has had a negative impact on economic growth. At present, overall population growth has slowed, with working-age population in particular on the decline, especially in developing countries. Since 2005, labour force growth across the globe has fallen to 1.1 percent, while global GDP has grown by a mere 3.5 percent on average over the past two decades. Slower population growth and an aging society will lead to continued sluggishness in the global economy. Since 2003, China's working population has grown at an annual rate of less than 2 percent, which turned negative for the first time in 2015. In the long run, depopulation will easily lead to labor shortage, lower levels of savings, and shrinking consumer demand, all of which will adversely affect China's economic growth.

Declining productivity is holding back global economic recovery. Since the beginning of the new century, productivity growth has continued to decline worldwide. More importantly, the slowdown in global productivity is likely to be a long-term trend that will significantly reduce the medium-to long-term growth of the global economy. In theory, emerging technological revolution will help improve productivity; nevertheless, productivity has seen negative growth despite booming global technological revolution and industrial transformation. China has made great strides in technology over the past decade, but its incremental capital-output ratio has been on the rise for the most part since 2008, reflecting to some extent the slowdown in China's productivity growth.

Growing debt is adding to the "burden" of global growth. Most debt crises have tipping points, usually in the fifth year of rapid debt growth. When debt growth exceeds 40% of GDP for five consecutive years, the economy will experience troubles. The rise in global debt indicates heightened debt risks. Since 2010, according to estimates by some international agencies, China's debt has risen to 300% of GDP in absolute terms, and increasing at an ever faster rate. Debt has outrun GDP for a rather long period of time, and ample liquidity will lead to lower productivity, bubbles and potential financial crises. The most important thing for China is to keep its debt under control.

De-globalization has become a prominent risk for global economic downturn. Since the 2008 financial crisis, globalization has been increasingly challenged by protectionism and isolationism. Under the influence of "de-globalization", economic barriers have increased, the growth rate of global trade and investment has slowed sharply, and the flow of people, goods, capital and information has met resistance. Global capital flows, which accounted for 16 percent of GDP in 2007, now account for a mere 2 percent. "De-globalization" can also be felt in China's economy, as reflected in the decline in the share of China's manufacturing exports in 2016 and the decline in the share of China's foreign direct investment in 2015.

- China’s economy should give full play to its own advantages to cope with global economic predicament

The ecosystem of science, technology and innovation will give a strong impetus to the upgrading of China's economy. At present, China in the new economic era is one of the most vibrant economic ecosystems in the world, with 40% of global e-commerce transactions completed in China, and 40% of the world's electric vehicles made in China. Moreover, China is the largest market for renewable energy and ranks among the top three countries in terms of venture capital investments in technologies. China manufactures about 30% of the world’s industrial robots, and contributes around 30% of the world’s unicorn enterprises. China's private economy is also becoming an important driving force to promote technological innovation, transformation and upgrading, creating nearly 70% of industrial output value. In addition, China's scientific and technological innovation has improved the overall quality of the labor force, enhanced the quality of employment, and helped optimize the employment structure.

With the destabilizing factors and uncertainties in China’s economy, it is important to set a more flexible target for economic growth. In fact, the driving force of China's rapid growth, like that of other developed countries, lies in industrialization and urbanization. Once the process plateaus, economic growth rate will inevitably slow down. Currently, China's economic development is facing many destabilizing factors and uncertainties, with potential fluctuations in indicators such as economic growth rate from month to month or from quarter to quarter. Based on the above considerations, it is important to reasonably lower the target for economic growth and adapt to the current potential growth rate, while giving more importance to the quality of economic growth, which is also in line with the requirements of "high quality development" of China's economy. This flexible target will also contribute to full employment, which is essential for the Chinese government.

It is wise to make good use of the "two hands", namely, the government and the market, and their respective advantages, to address the increasingly prominent debt problem. At present, the development model based on the issuance of debt and currency is no longer sustainable. In the past few years, the Chinese government has been aware of the existence of such bubbles and has begun to take solid measures to solve the issue of debt and leverage. Debt can be dealt with through coordination by the Chinese government, with the price of real estate and other assets kept under control, thus allowing China's debt to be slowly digested through sustained economic growth. Debt can also be dealt with by a market-based approach, such as debt restructuring, asset securitization, and liquidation, which will help reduce debt risk and invigorate China's economy in the medium to long term.

Gallery

https://en.cdi.org.cn/component/k2/item/632-global-economic-predicament-and-china-s-development-in-the-4d-world#sigProIdf17539beeb